Explore the movements of the Australian property market in 2023 in Aussie's latest housing report. drawing on data gathered from Lendi, Aussie, and Domain Home Loans.

This report provides an in-depth look at the lived experiences of households and the effects of sustained economic pressure on home loan holders across Australia.

What happened to home loan interest rates in 2023?

Throughout 2023, the Reserve Bank of Australia implemented a series of 5 cash rate increases, resulting in a combined rate increase of 1.25% over the year.

This followed a cycle of 8 consecutive cash rate rises in 2022, bringing the total number of rate hikes to 13, with the cash rate escalating from 0.10% in April 2022 to 4.35% by the end of 2023.

Unsurprisingly, many lenders chose to align their home loan interest rate movements with successive cash rate increases witnessed over the past two years.

You can keep up with interest rate movements with our Interest Rate Tracker.

You might also be interested in: When and when not to refinance your home loan

Can refinancing save you money?

According to the Lendi Loyalty Index, the average rate that existing borrowers are still paying as of November 2023 is still 0.29% higher than what’s being offered to new borrowers.

This is a huge improvement on the difference that existing vs. new borrowers were being charged in 2022, which was around 1.25%. However, there are still plenty of potential refinance saving opportunities for current borrowers to explore.

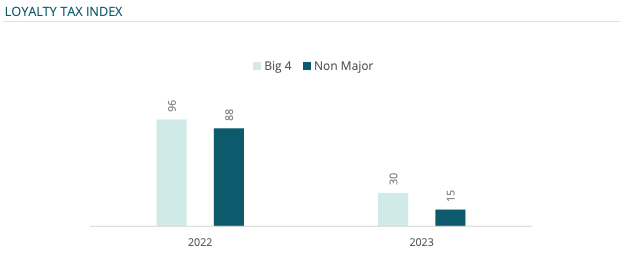

Did you know? The Lendi Loyalty Index tracks the difference between interest rates that lenders are offering their new customers vs. their existing loyal customers – also known as ‘loyalty tax’.

On average, customers of the Big 4 Banks experienced a .30% Lender Loyalty gap in 2023, whereas customers with non-major lenders only saw a 0.15% difference.

You might also be interested in: Home loan refinancing process and timeline

How to save money refinancing your mortgage

Refinancing your home loan can be a smart strategy to save money. Here are a few ways you could potentially save by refinancing your home loan:

1. Switching home loans to a lower interest rate

The data above shows that many mortgage holders are still overpaying on their home loans and there are potentially lower mortgage rates to explore.

A lower interest rate can result in significant savings over the life of your loan and could even potentially shorten your loan term.

Even a seemingly insignificant reduction can mean huge savings in interest.

An Aussie Broker can help negotiate your interest rate with a new or even your existing lender.

2. Getting a low-fee home loan

A low-fee home loan is a mortgage option with minimal upfront costs and ongoing fees.

Home loans typically come with various fees, such as application fees, monthly service and annual fees and closing costs.

A low-fee home loan is designed to keep these costs as low as possible for the borrower.

3. Taking advantage of rewards and incentives

Many lenders offer discounts or incentives to new borrowers and refinances, such as cashback offers.

While it’s important to weigh the costs and gains of refinancing and a cashback incentive shouldn’t be the only consideration when refinancing, it could be the cherry on top of a better home loan deal.

Remember, refinancing your mortgage involves considering various factors and understanding your individual financial situation.

It's a smart move to ask your local Aussie Broker or financial advisor for support throughout the process.

Lendi Group Loyalty Tax Index

How has home loan refinancing changed in 2023?

In November 2023, refinancing accounted for 69%, of all loan activity at Lendi, Aussie, and Domain Home Loans.

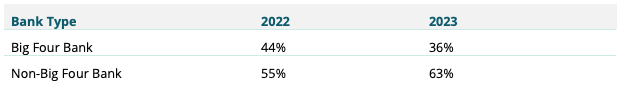

During this period, there was a noticeable decline in market share for the major banks.

What's interesting to note is that more than 6 out of every 10 refinances that took place throughout the year occurred outside of the Big Four banks. This indicates a growing preference for non-major banks for borrowers looking to refinance their loans.

Additionally, as of November 2023, non-major banks are still offering variable rates that are on average 0.16% lower than what the Big Four banks are offering.

Loyalty tax gap: Big 4 Banks vs. non-major lenders

What were the Loan to Value Ratios of refinancers in 2023?

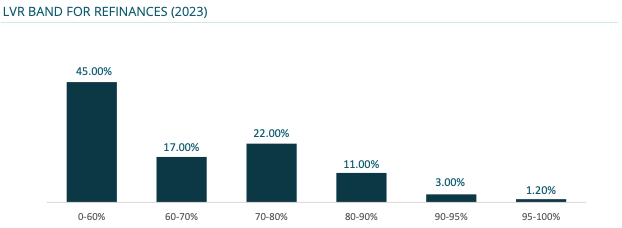

Despite ongoing mortgage rate movements and the higher interest rate environment across Australia, there was a slight decrease of 0.2% in the number of homeowners refinancing in the 95-100% Loan to Value (LVR) band.

On the other hand, those in the 90-95% LVR band remained steady at 3%, while there was a 2% increase among mortgage holders who shifted into the 80-90% LVR band.

Interestingly, in 2022, more than half (51%) of Australian borrowers who refinanced owned more than 60% of their homes. However, this percentage dropped to 45% in 2023.

Did you know? Your Loan to Value Ratio signifies what portion of the value of your property you are borrowing. The lower your LVR, the better.

In terms of regional differences, despite having the highest property values, borrowers in New South Wales had the lowest LVRs compared to borrowers from other states across the country.

You might also be interested in: How to access equity to renovate your home

LVR band for refinances in 2023

If you’d like to learn more about refinancing and see if you can save, get in touch with your local Aussie Broker for free help.

*2023 data is representative of loans and applications made across Lendi, Aussie and Domain Home Loans from January 2023 to end of November 2023

*2022 data is representative of loans and applications made across Lendi, Aussie and Domain Home Loans from January 2022 to December 2022