Keeping your current home can supercharge long-term wealth if rental income is reliable

Selling unlocks a cleaner, faster path to your next home, freeing up funds for a bigger deposit

Lenders don’t count 100% of rental income when assessing your loan eligibility

Buying a bigger home is exciting. But if you already own a place, the question of what to do with it, sell or hold onto it as an investment, can overshadow the thrill of the new.

According to Aussie’s Find, Buy, Own survey, nearly 1 in 2 Australians say the current housing market has made upgrading more complicated, with many unsure how to make the most of their existing equity.

This decision can have long-term financial implications, both good and bad, and the right answer depends on your goals, your cash flow, and the market you're buying (and selling) into.

In this guide, we’ll break down both options, selling or holding, to help you weigh up what’s right for you. We’ll also show you how Aussie Brokers can help you plan either pathway, stress-free.

The upside of keeping your current home

Many upgraders consider turning their existing home into an investment property. If that’s on your radar, here are the key benefits to think about.

1. Rental income can help service your new loan

If your current property is in a rental-friendly area, you may be able to generate reliable income while paying off your next home. Depending on the rent, it could even cover a large portion of the mortgage.

2. You’ll benefit from double exposure to capital growth

If both homes are in areas with strong growth potential, holding onto your first property could boost your long-term wealth. You’ll be growing two assets at once, without selling out of the market.

3. No need to sell under pressure

In some cases, keeping your home gives you more time. Maybe market conditions aren’t ideal for selling, or you want to avoid juggling settlement timelines. Holding your property can relieve that stress.

You might also be interested in: Should you pay off your mortgage early or invest instead?

The challenges of becoming a landlord

There’s no doubt that holding onto your current property has potential upsides, but it also comes with risks and responsibilities.

1. You’ll likely need a bigger deposit or strong equity

Without selling your current home, you won’t have sale proceeds to put towards your upgrade. That means relying on savings, existing equity, or a guarantor to make up your deposit.

An Aussie Broker can help you use tools like the equity calculator to see where you stand.

2. Two mortgages can stretch your budget

Even if your old home is tenanted, you’ll need to meet both loan repayments if the property is vacant or the rent falls short. That makes cash flow management critical, especially if interest rates rise.

3. You’ll take on the role (and risks) of a landlord

From maintenance costs to insurance and property management fees, owning an investment property isn’t hands-off. You’ll also need to understand legal obligations, like smoke alarm compliance and bond lodgement.

4. Tax implications can be complex

If your old home becomes a rental, it may be subject to Capital Gains Tax (CGT) when you sell. And if you’ve claimed depreciation or other tax deductions, those may impact your tax return. An accountant or financial adviser can help you navigate this.

The case for selling and reinvesting in your next home

There’s nothing wrong with selling your current home to fund your next move. In fact, for many upgraders, it’s the simpler, safer route.

1. Unlock more funds for your upgrade

Selling your existing home lets you free up equity and pour it into a larger deposit for your next purchase. That could help you avoid Lenders Mortgage Insurance (LMI) or reduce the size of your new loan.

2. One mortgage = less stress

Managing just one loan often means a more straightforward financial picture. You’ll have fewer moving parts, clearer cash flow, and only one repayment to worry about.

3. Buy sooner, buy smarter

With extra funds from the sale, you may be able to access a wider range of properties or secure your next home faster. That’s especially useful in competitive markets where timing matters.

Tip: Use the borrowing power calculator to see how selling could improve your loan options.

Can you afford to keep both?

Let’s break it down with an example. Say you’re upgrading to a $1.1M home and considering keeping your existing $700K property (with a $350K mortgage remaining). Rent might cover some of your first loan, but will your income support the new loan too?

What lenders will look at:

Factor | What it means |

|---|---|

Your income | Needs to cover both loans. Lenders will stress test repayments. |

Rental income | Only 70-80% is usually counted as usable income. |

Equity position | Do you have enough equity to form the deposit for your new home? |

Debt-to-income ratio | Can your income service both mortgages under higher rates? |

An Aussie Broker can compare both scenarios for you, with or without selling, so you can see the difference between black and white.

You might also be interested in: Tips for upgrading or renovating your home

How to make the right decision for you

There’s no one-size-fits-all answer. But asking these questions can help bring clarity:

What are the current market conditions?

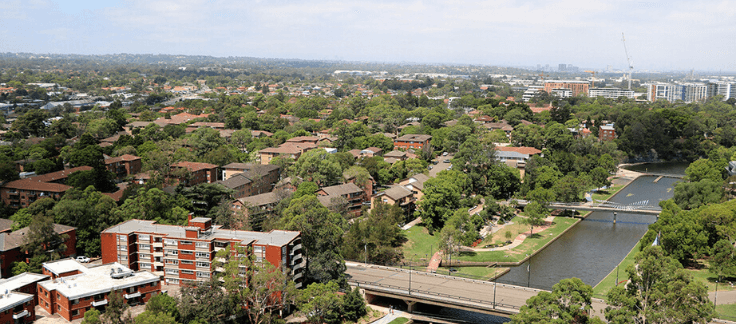

If your home is in a high-demand suburb with strong rental yield or rising values, it might be worth keeping. On the other hand, if it's a seller’s market, you might fetch a premium price now.

Request a free property report from Aussie to get suburb insights and estimated value.

Are you comfortable managing two properties?

If you’re time-poor or risk-averse, becoming a landlord might not align with your lifestyle. Selling may bring peace of mind, even if it means exiting the investment opportunity.

Do you have the right team in your corner?

Whether you decide to hold or sell, you don’t have to figure it all out alone. An Aussie Broker can walk you through the financial side of both options, including your updated borrowing power, likely repayments, and future refinance potential.

Upgrading is a big move, make it a smart one

Your current home could be your next investment, or it could be the key to unlocking a better property for your family today. Both paths have merit. What matters most is choosing based on strategy, not just sentiment.

With the right advice, tools, and a broker who’s in your corner, you’ll have the confidence to make the next move that works for you.

Get a ‘keep or sell’ assessment with an Aussie broker