As the new financial year approaches, with it comes the implementation of the adjusted stage three tax cuts, borrowers and mortgage holders may find themselves with more options than they first thought.

Aussie has crunched the numbers on a range of scenarios for potential purchasers on what impact the imminent stage three tax cuts will have for those trying to maximise their borrowing capacity when seeking out a home loan.

The stage three tax cuts, which will affect 13.6 million Australians, reduce the 32.5 per cent tax bracket down to 30 per cent and increase the 37 per cent threshold from $120,000 to $135,000. Additionally, the 45 per cent threshold is being increased from $180,000 to $190,000, and the lowest tax bracket drops to 16 per cent, from the current rate of 19 per cent, for those earning between $18,000 to $45,000.

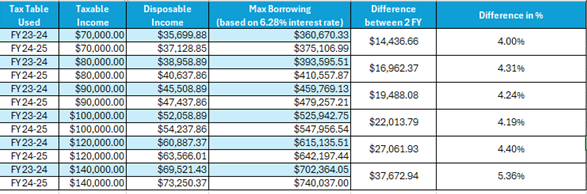

One such scenario explored by Aussie highlights that single Australians with no dependents earning $120,000 per year in FY24, who could borrow a maximum $615,135.18, will increase their borrowing capacity in FY25 by $27,061.93 on a mortgage based on a 6.28% interest rate to $642,197.44.

A married couple with two dependents earning a combined taxable income of $280,000 will increase their borrowing capacity by $75,345.89 on a mortgage with a 6.28% interest rate in FY25, which is a 5.64 per cent increase on their previous maximum borrowing amount of $1,334,871.22.

Aussie Chief Operating Officer, Sebastian Watkins, said the stage three tax cuts can have some serious implications for those who are just outside their ideal borrowing capacity.

“Through our extensive broker network, we have been receiving feedback that many potential purchasers are just coming short of the desired amount they need to purchase their dream home especially as the price of property increases quicker than their ability to save or their wages to grow.”

“They evidently have two choices; look elsewhere for something cheaper and most likely less desirable to them or continue trying to save as much as they can whilst hoping their incomes grow at a higher rate than property prices.”

“These tax cuts will mean there is a cohort of purchasers, who come July 1st, will increase their borrowing capacity as their net income will grow and they will have more optionality when seeking finance for a home”.

For those who are still outside their desired borrowing capacity even with the tax cuts, Sebastian stresses the need to remain focused on the end homeownership goal.

Stage Three Tax Cuts Borrowing Power

“Even if the tax cuts don’t automatically bump you up enough in terms of borrowing capacity, the additional income can be funneled straight into extra savings for your deposit. Ultimately the healthier your deposit the less you need to borrow, so this is really a win-win situation for those ready to enter the market”.

Stage three tax cuts could save years off average home loans

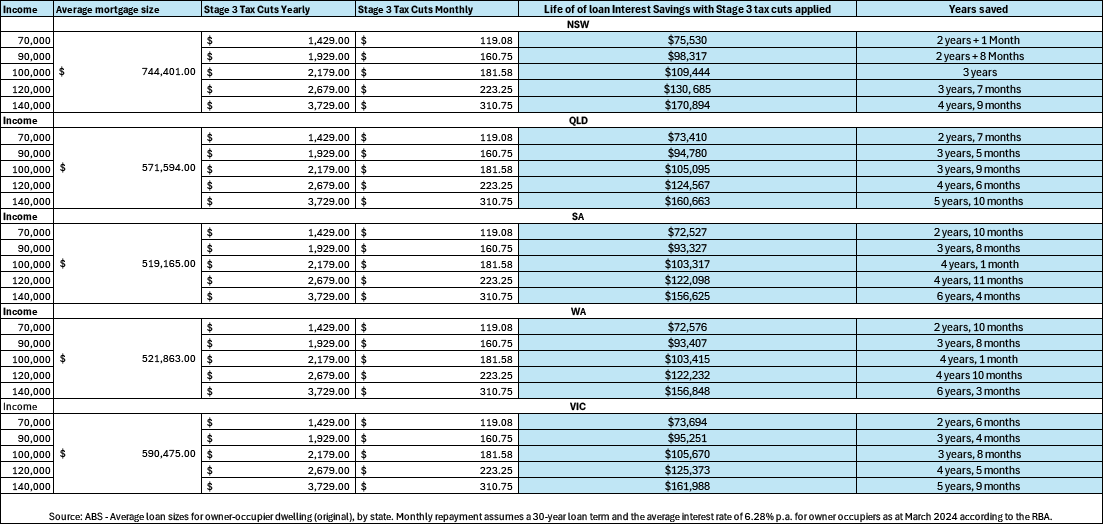

Homeowners who put their entire stage-three tax cut savings on their mortgage could shave two to six years off the life of their loan, saving thousands.

Those earning $70,000 and who put their full monthly saving of $1429 on their loan could reduce repayments by two to three years and pocket up to $75,530 in interest payments over the entirety of the debt.

For someone on double that wage, savings climb to as much as $171,000 and borrowers could unchain themself from their bank six years early.

State by State break down on mortgage savings

table

ENDS

About Aussie

Aussie was founded in 1992 and was widely credited for bringing competition to the Australian home mortgage broking industry. For 30 years, Aussie Brokers have put home ownership within reach of more Australians, helping over 1 million customers with their home loan journey. With more than 1000 brokers and more than 230 stores nationwide, Aussie has the largest retail brokerage footprint across Australia.