45% homeowners plan to sell and buy, but feel like they can’t.

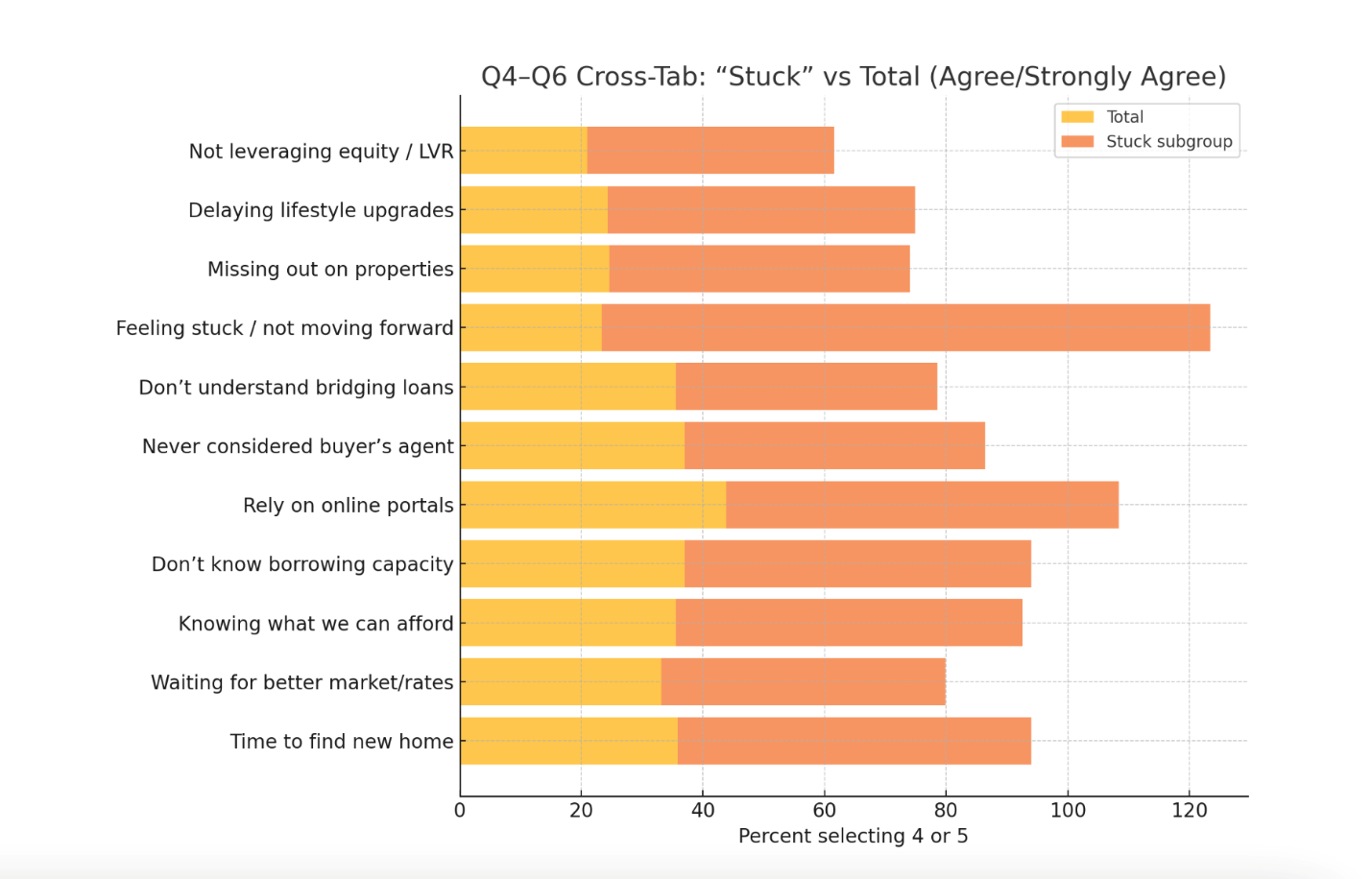

Over one-third of homeowners don’t know their borrowing power (37%) or understand how bridging loans work (36%), while only 21% are leveraging their equity to move forward.

Missed opportunities are mounting: nearly 50% of “stuck” homeowners have already missed out on a property or delayed an upgrade.

Aussie conducted a survey in July 2025 that revealed nearly half of homeowners have plans to sell and upgrade to a better home, but most aren’t moving. Stuck between rising prices, tricky lending rules and a shortage of listings, millions of Australians are staying in homes that no longer fit their lives.

They reported feeling stuck with timing fears, financial guesswork, emotional trade-offs and a lack of expert support. And it’s not just affecting would-be upgraders. It’s rippling out to first-home buyers, downsizers and investors too - anyone who’s unsure of their next step in an evermore competitive property market.

When you don’t know what you can afford

One of the clearest signals in the data was a widespread lack of financial clarity. More than a third of homeowners surveyed said they don’t know how much they can borrow, 36% are unclear on how bridging loans work, and just 21% are actively using their equity to plan or fund their next move.

Broker Samantha Harvey says this knowledge gap is one of the most common, and costly, roadblocks she sees.

“This doesn’t surprise me at all. In fact, I’d say anecdotally the actual number might be higher,” she says.

“Many people either assume they can’t borrow, or overestimate what they can borrow, and both assumptions are risky. Until you’ve had a proper conversation with a broker who can assess your financial situation and run real numbers, you're flying blind.”

Even those who’ve spoken to a broker in the past may be relying on outdated figures.

“Borrowing power changes, lender policies change, rates change, your financial position changes. If you're still using numbers from a year ago, you might be planning for a reality that no longer exists.”

And for many, that delay has ripple effects - postponing plans to upgrade, invest or renovate.

Aussie. Everything you need to find, buy and own.

Equity-rich, action-poor

There’s a lot of untapped potential sitting in homes around Australia and not just in capital growth.

“People often don’t think of equity as something they can use,” Harvey explains. “But it can help fund renovations, consolidate debt, or even go toward a new car or holiday. For upgraders, it can be the key to unlocking a smoother path forward.”

Smart uses of equity, she says, can turn gridlock into momentum, especially when it comes to bridging finance.

“If you’ve built up solid equity, you might be able to buy before you sell. That’s a game-changer for families worried about timing or missing out on the right property. It gives you breathing room and less stress, more flexibility.”

Equity can also be used strategically to prep your existing home for sale, funding cosmetic upgrades or improvements that could significantly boost resale value.

The most misunderstood tool in the kit

Homeowners aren’t just confused about what they can borrow. Many are unclear about how to manage the logistics of buying and selling at the same time and bridging finance gets an especially bad rap.

“The biggest misconception is that bridging loans are too risky or too expensive,” Harvey says. “In reality, they’re a practical short-term tool if used the right way.”

She often sees confusion around eligibility.

“People assume owning a home means they’ll automatically qualify. But some lenders assess you based on peak debt - which can make it harder. Others assess based on end debt, which is often more realistic. The key is finding the right lender and the right strategy.”

The logistical black hole

Many homeowners are stuck not just financially, but emotionally, worried about being caught between selling and buying with nowhere to go.

“It’s one of the most common concerns I hear, and it’s completely valid,” says Harvey.

“There’s rarely a perfect solution, but there’s always a best-fit strategy based on your circumstances and what you’re willing to trade off.”

Some might choose to sell first and rent temporarily. Others might attempt a simultaneous settlement. And some, with the right equity and advice, may be able to buy first and sell later with confidence.

“It comes down to planning and risk tolerance. Do you want certainty on your next home? Are you OK carrying some short-term debt? Would you accept a slightly lower sale price to avoid more stress?”

Still relying on real estate listings? You’re not alone.

Despite the complexity of the current market, many homeowners are still going it alone.

44% of people surveyed rely solely on listings sites to find their next home

37% have never considered using a buyer’s agent

Among those who feel most stuck, the figures are even higher:

64.6% of those surveyed use only listings portals

49.4% have never spoken to a buyer’s agent

“This is a classic case of not knowing what you don’t know,” Harvey says. “Most people don’t realise how much value professionals like buyer’s agents or brokers can add until they’ve missed an opportunity, or made an expensive mistake.”

Source: Aussie survey data July 2025

Families face extra complexity

The decision to move isn’t just about finances - it’s deeply personal and for families, it’s even harder.

Only 22% of all homeowners Aussie surveyed said leaving a school or community would stop them from moving. Among family households, that jumps to 31%. And families make up 43% of the “stuck” segment.

Add that to the logistical jigsaw puzzle of settlement dates, childcare, commute changes and emotional upheaval, and you’ve got a recipe for standstill.

The real cost of waiting

This gridlock isn’t hypothetical. It’s showing up in missed opportunities and delayed goals.

1 in 4 homeowners surveyed by Aussie in July 2025 say they’ve missed out on a property because they weren’t ready

Another 24.3% have delayed upgrades that would improve their lifestyle

For those who already feel stuck, the numbers nearly double:

49.4% of people surveyed missed out on a property

50.6% delayed a move that would improve their everyday life

So, what’s the fix?

It’s a clarity problem. People aren’t unwilling, they’re just unsure.

“What I wish more people knew is how powerful it is to start the conversation early,” says Harvey.

“We’re not just here to get you a loan. We help you figure out what’s possible, who you should talk to, and how to structure your move in a way that works for your life.”

What homeowners really need:

A clear understanding of their borrowing power

A plan for how to use (and grow) their equity

Expert advice on managing timing, risk and settlement sequencing

A strategy tailored to their family, finances and future goals

“It doesn’t cost anything to speak to a broker,” Harvey says. “But it can save you time, stress and even money in the long run.”

Right now, too many Australians are living in homes that no longer serve them: equity-rich but stuck, not because they’re indecisive, but because they’re uncertain.

If half of would-be movers surveyed by Aussie are sidelined by timing fears, a third don’t understand their financial options, and one in four are missing out on properties they want. That’s not a housing shortage, it’s a knowledge shortage, which is absolutely solvable.

All data sourced by Aussie, July 2025.