Spring is the peak season for property, and this year we’re seeing some exciting opportunities for Aussies to kick their property goals.

The big news this spring, is the number of cash grants available for new home buyers or builders.

The HomeBuilder scheme available nationally, is worth $25,000 to eligible buyers who build a new place or make substantial renovations to an established home. And it’s backed up by a number of state-based grants.

Tasmania has its own HomeBuilder grant worth $20,000. West Australian home buyers (investors too) may be eligible for the $20,000 Building Bonus. And in the Northern Territory, new home buyers may be able to claim the $20,000 BuildBonus.

Nationally, new home sales jumped 211% after the grants were announced.

For some, this could be a good opportunity to take advantage of. Your Aussie Broker can give you more guidance on how the grants work, and whether you may be eligible.

Home loan rates break 2% barrier

More good news for Spring buyers – we’re seeing home loan rates break the 2% barrier, plus more loans below 2.5%.Aussie has been in the market for nearly 30 years, and we’ve never seen rates this low. Even better, the Reserve Bank has not increased the interest rate since the latest announcement on October 6 2020.This is fantastic for home buyers, and it’s important to catch up with your Aussie Broker to know how you can take advantage of today’s low rates.

Property market holds firm

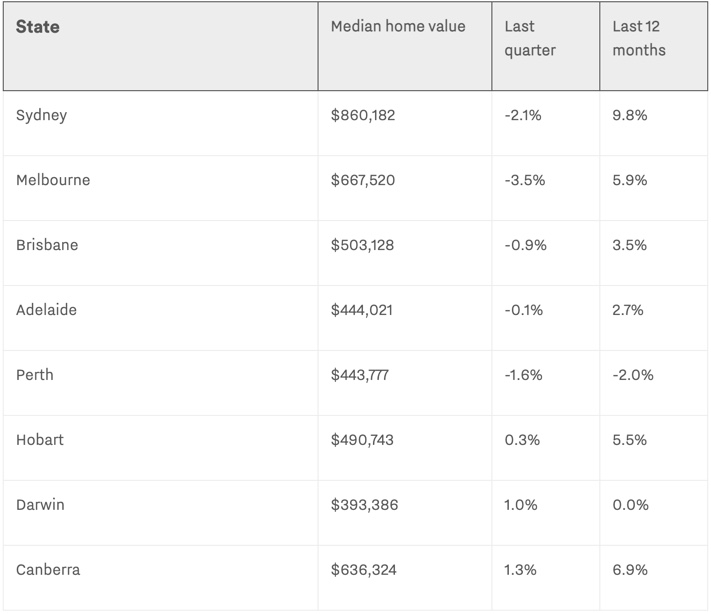

Taking a look around the nation, the quarter that ended 31 August 2020 saw Melbourne facing strict lockdowns, and property values in the Victorian capital declined 3.5%. But this needs to be put in perspective – Melbourne values are still up 5.9% over the past 12 months.Sydney values dipped 2.1% for the quarter. Though again, the annual gains remain at a very healthy 9.8%. Other cities which saw slightly cooler prices include Brisbane (down 0.9% over the quarter), Adelaide (-0.1%) and Perth (-1.6%).On the flipside, we saw healthy quarterly rises in Hobart (up 0.3%), Canberra (1.3%) and Darwin (up 1.0%).

Change in home values

Data up to 31 August 2020

CoreLogic Hedonic Home Value Index 1 September 2020

First home buyers get into the market four years sooner

A more affordable market is a windfall for first home buyers. And it comes with the second round of the First Home Loan Deposit Scheme (FHLDS), which lets first-time buyers get into the market with a 5% deposit and no lenders mortgage insurance.

It’s great to see data from the FHLDS showing the Scheme is helping first home owners bring forward their purchase by an average of four years.

Loan pre-approvals jump 71%

They say that good things often come from bad, and the silver lining of the pandemic is that Aussie homebuyers are becoming better prepared before purchasing a property.

Aussie has seen a record 71% jump in home loan pre-approvals this year, including a 130% jump in pre-approvals among first home buyers. It means borrowers are giving themselves as much certainty as possible in an uncertain environment – and that’s a smart move.

As we all adjust to the ‘new normal’ of COVID-19, spring 2020 is shaping up as an exciting season where buyers can benefit from generous cash grants, more affordable values and home loan interest rates that have to be seen to be believed.

Talk to your Aussie Broker to know how you can kick your property goals this season.