Stagnant incomes, higher mortgage repayments, increased barriers to entry and stubborn lender loyalty tax are the key findings of the Lendi Group 2023 Home Loan Report. This unusual mix of cost pressures illustrates a year of sustained mortgage strain on current and prospective Australian homeowners.

The report, comprising data collected across Lendi, Aussie and Domain Home Loans from January to the end of November, provides a worrying snapshot of the lived Australian property experience in 2023 and the real impacts of sustained economic pressure on households.

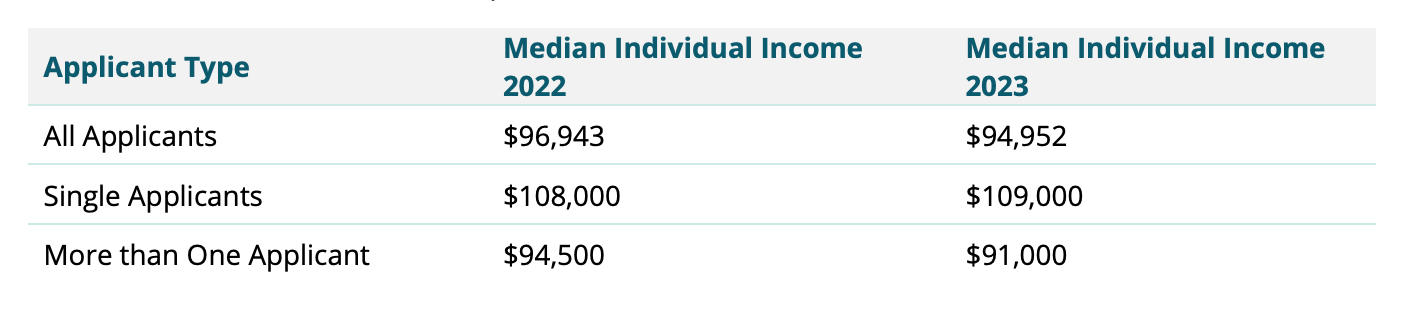

Over the course of 2023, the median income for borrowers fell by 3% to $95,000,

despite variable mortgage rates for Owner Occupiers increasing by 40% across

the year or $528 a month on a $500,000 variable, P&I loan.

Lendi Group Co-Founder & CEO David Hyman says this higher rate environment brought with it significant affordability challenges, particularly for the younger generation and those on an average wage.

“The data show’s Australian’s have met unprecedented head winds in their fight for the Aussie dream, an environment not seen for the past 12 years, yet they are not giving up on the prospect of homeownership.

This graph shows the median income of borrowers in 2023.

“The data tells of income stagnation coupled with rising costs, but it is all compounded by a loyalty tax to existing borrowers not making a lender switch. This is why it is crucial for homeowners to challenge the status quo and reclaim their agency, to ensure they are getting the best deal in a difficult market.

“Across all loan applications, the average age of single borrowers was 41 and for couples was 40, showing just how hard it is for the younger generation or those on lower incomes to make it in Australia’s property market under current market conditions.

“Our data shows just 20% of all home loan applicants this year were single and earned a median income of $109,000 a year. This suggests you either need a dual income household or earn well above the Australian average wage to be able to afford a home loan, which locks out a considerable portion of the nation’s population.

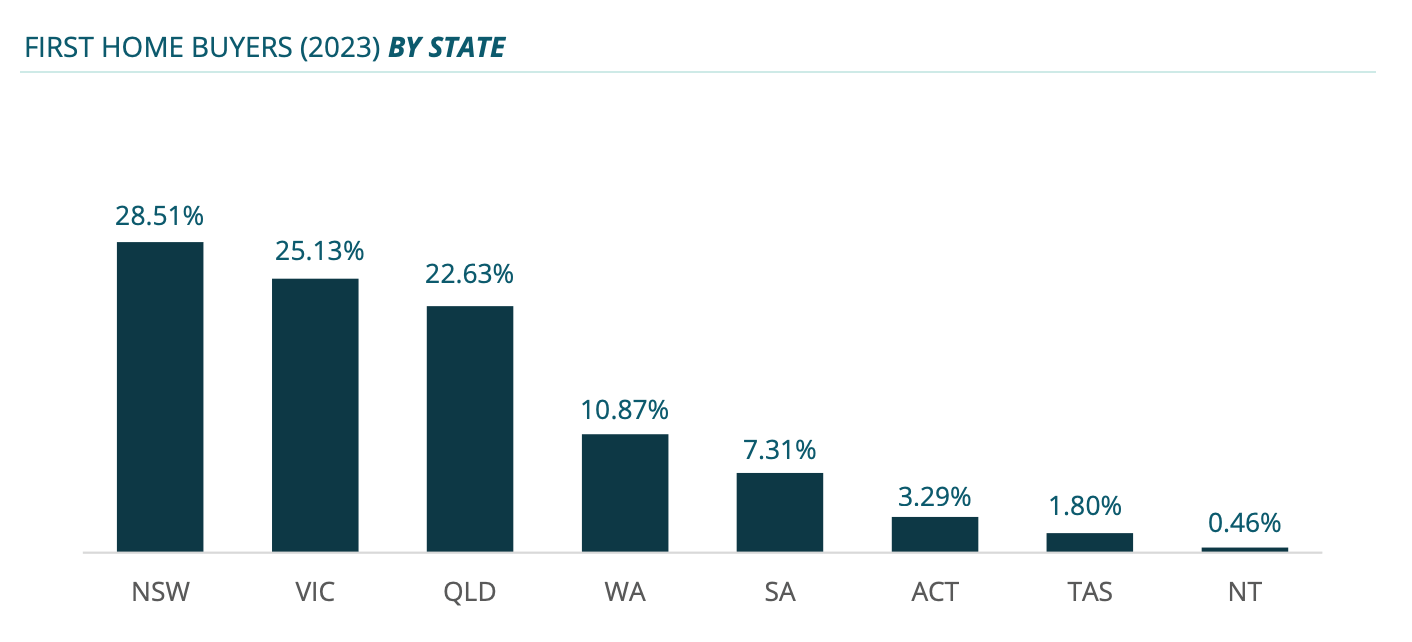

This graph shows how many purchases were made by First Home Buyers per state.

“We also know First Home Buyers are being hit the hardest, bearing the brunt of the higher rate environment. Over 2023 we saw a 12% decrease in home loan applications among this cohort. Now, First Home Buyers account for just 35% of all loan activity, which is a significant fall on 2022.

“But despite these barriers to entry, new purchases are up 6%, even if affordability on what people can buy is down. This shows Australians are willing to give up on a lot of other things, before they give up on the dream of homeownership.”

The Home Loan report also illustrates a series of persistent market challenges for existing homeowners, with equity on the decline and average purchase value for new purchases in 2023 falling by 2% across the Nation.

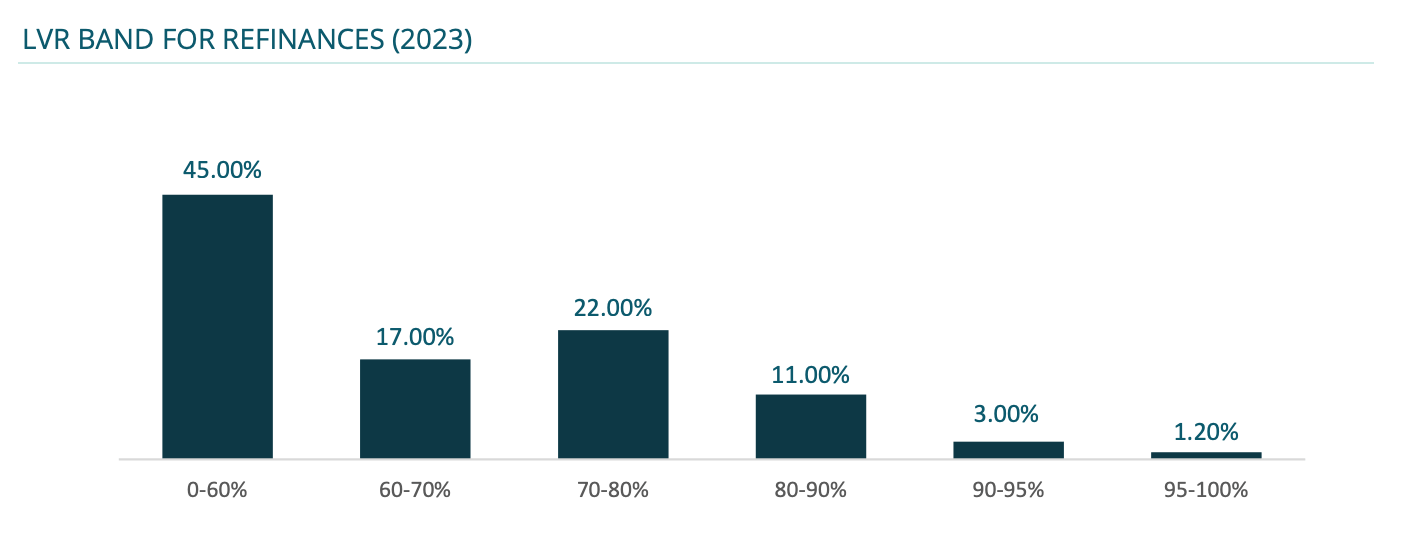

“In 2022, 51% of Australian borrowers who refinanced owned more than 60% of their property, however this fell to 45% in 2023, which means more Australians own less of their homes.

Despite the higher rate environment, Australia wide, the number of homeowners who refinanced in the 95-100% Loan to Value (LVR) band decreased by 0.2%.

This graph shows the number of homeowners who have refinanced in different loan-to-value ratio bands.

“Seeing the amount of equity retreating in 2023 is disheartening. As Brokers we know equity is a powerful asset which not only provides homeowners a safety net and the ability to decrease mortgage payments but can be used to fund renovations and for parents, support their children to get their own foot into the housing market.

“We also saw fewer people refinancing, despite the number of homeowners rolling off their fixed-rate home loans rising, suggesting an increased level of apathy. Our message to these property owners is that there is still competition in the market and deals to be had, evidenced by the increasing number of borrowers switching to non-major banks.

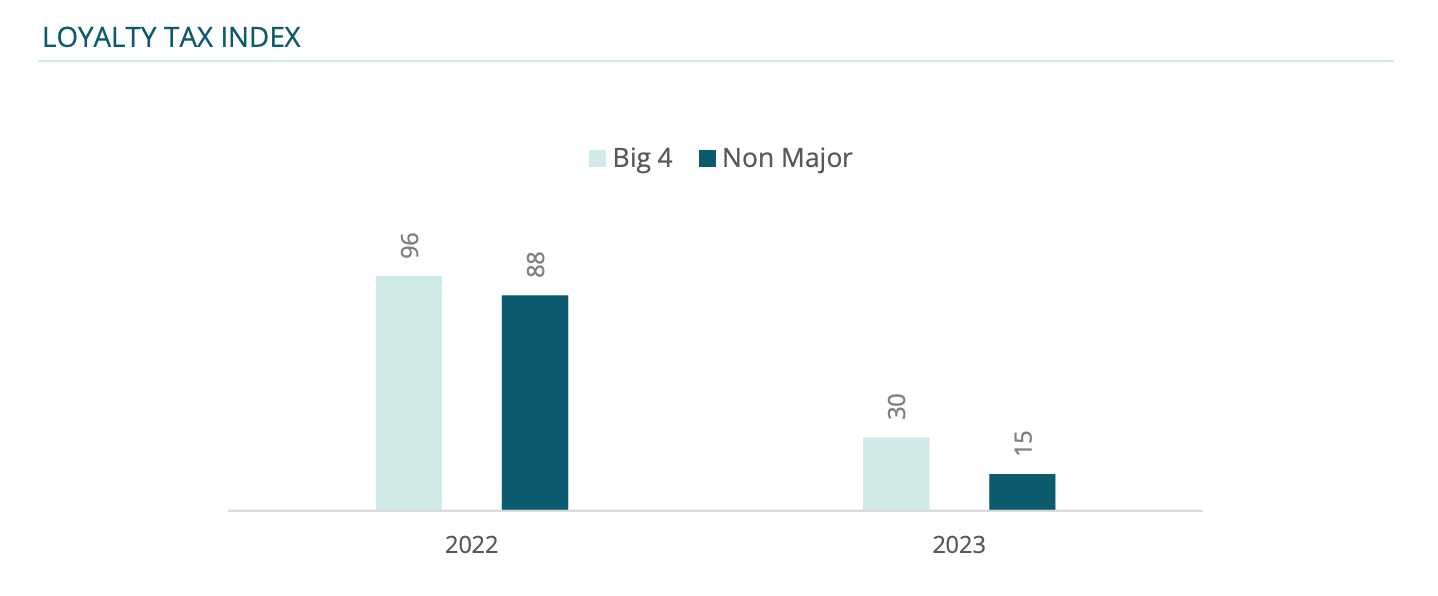

“We also know Lender loyalty tax is still present and having a big impact on what borrowers are paying each month. Right now, existing borrowers are on average being charged rates 29 basis points higher than new borrowers. 29 basis points might not sound like life changing money, but refinancing and saving this can counteract an entire rate increase.”

This graph shows banks and lenders continue to prioritise new business over existing clients.

Despite the difficulties faced by current and prospective homeowners in 2023, Lendi Group remains positive that the challenges in the market can be met and that more, regular Aussies can afford homes and challenge the institutions to do better, with an expert in their corner.

“Every rate increase in 2023 has led to more conversations between our brokers and people that have woken up to the difficulties of the current market. Now 71% of all mortgages in the market are facilitated by a broker, and everyday our teams are helping borrowers make decisive moves to either crack into the market or get a better deal and save on their household’s bottom line.

“While we don’t expect the challenging conditions of 2023 to vanish in 2024, our mortgage brokers expect to use every tool they have in the year ahead to equip borrowers to navigate these hard times and continue to create wealth through homeownership.”

Download the full report here.