From soaring interest rates and rental prices to increasing grocery costs, there’s no denying that many Australians are struggling to keep up with the rising cost of living. That said, there are a number of key differences in living expenses across the different states, territories and capital cities.

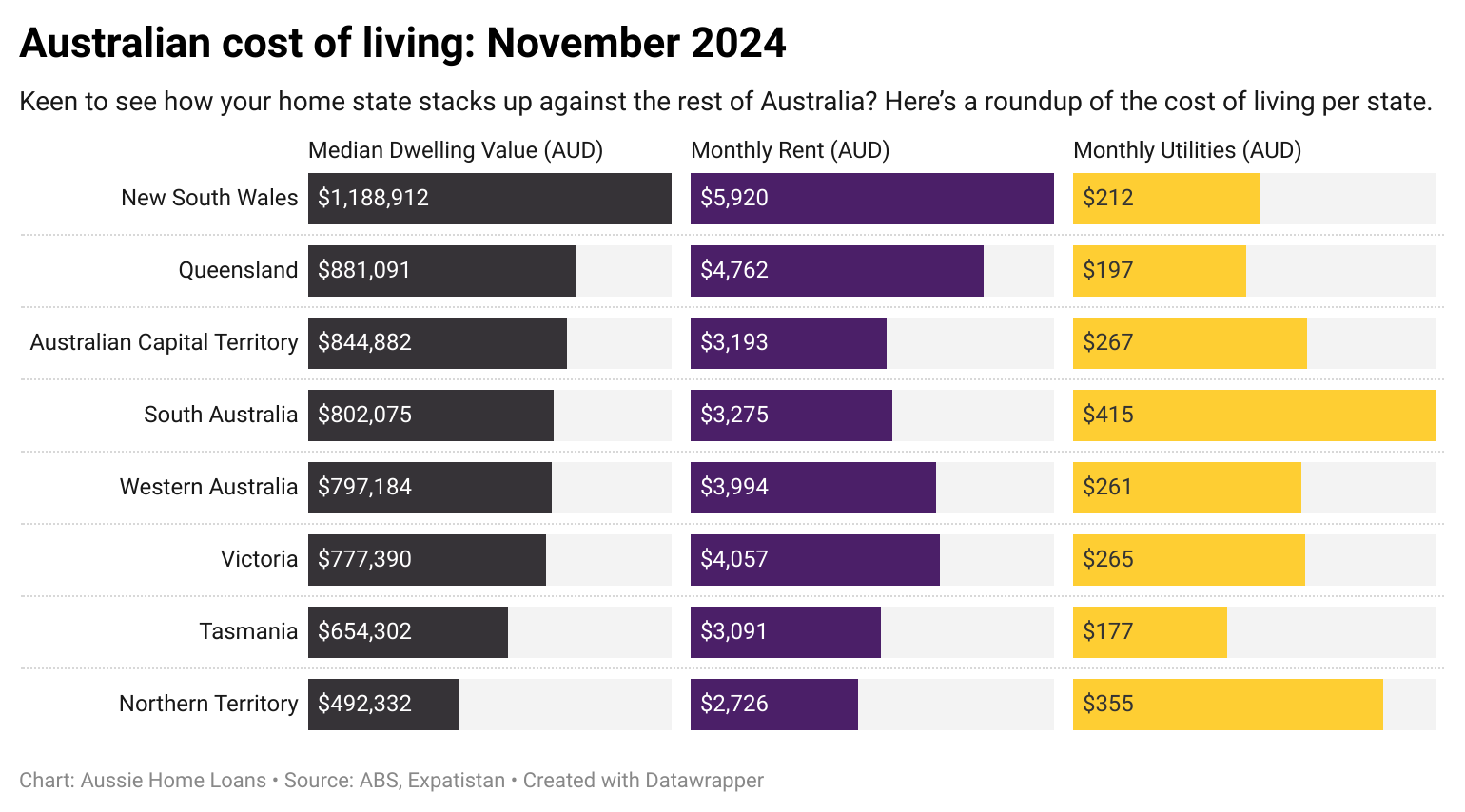

Keen to see how your home state stacks up against the rest of Australia? Here’s a roundup of the cost of living across states and key cities.

Sydney

As one of the country’s most expensive cities to live in, the cost of living in Sydney outpaces the other capitals around Australia, especially when it comes to housing and utilities. As of the 30th of September 2024, the median dwelling value in Sydney was $1,188,912. But expensive housing doesn’t end there. It also extends to the rental market too.

According to Expatistan, a furnished 85m2 apartment in an expensive area of Sydney will set you back roughly AU$5,920 per month in rent, with utilities for two people adding an extra AU$212 to the monthly total.

That said, the NSW government has a number of vouchers and rebates on offer to help eligible residents combat the cost of living pressures.

You might also be interested in: First home buyer grants and concessions in New South Wales

Wondering if you could be saving more? Reach out to our Sydney based mortgage brokers and see if you could be getting a better deal or saving more.

Canberra

According to CoreLogic’s October Hedonic Home Value Index (HVI), the median dwelling price in Canberra is sitting at $844,882.

In terms of rent, a furnished 85m2 apartment in an expensive area of Canberra will set you back roughly AU$3,193 per month, making it one of the more affordable capitals to rent in. But don’t forget to factor in utilities for two people in an 85m2 apartment, which comes in at around AU$267 per month.

From stamp duty cuts and energy rebates to offering rental loan bonds, the ACT government is doing what it can to provide residents with cost of living support.

You might also be interested in: First home buyer grants and concessions in the Australian Capital Territory

Melbourne

Although Melbourne was once considered one of the most expensive cities in Australia to buy, dwelling values have continued to fall during the September quarter. As of the 30th of September 2024, the median dwelling value in Melbourne was $777,390, making it the 6th most expensive capital behind Sydney, Brisbane, Canberra, Adelaide and Perth.

But when it comes to other living costs in Melbourne, like rentals, the city still ranks as one of the most expensive capitals. A furnished 85m2 apartment in an expensive area of Melbourne will set you back roughly AU$4,057 per month, plus an extra AU$265 a month for utilities for two people.

The Victorian government is offering energy bill relief and additional support to help cover the cost of kids’ school as a means of helping residents with the cost of living.

You might also be interested in: First home buyer grants and concessions in Victoria

You can also get in touch with an Aussie mortgage broker in Melbourne to help you work out what financial options you have available to you.

Brisbane

Brisbane made headlines earlier this year when it overtook Melbourne and Canberra to become the second-most expensive city for housing in the country. Based on the latest CoreLogic HVI, Brisbane has maintained its position and continues to experience growth in property values despite other cities losing momentum.

With a median dwelling value of $881,091, Brisbane is Australia’s second most expensive capital to buy in, behind Sydney. It’s also up there in terms of rent, with a furnished 85m2 apartment in an expensive area of Brisbane setting you back roughly AU$4,762 per month and another AU$197 per month for utilities for two people.

The Queensland government has introduced several schemes to help relieve cost of living pressures, including a $1000 energy rebate, 20% off car rego fees and 50 cent public transport fees, to name a few.

You might also be interested in: Queensland’s $30K First Home Buyer Grant & stamp duty changes

Perth

Perth's dwelling values increased by 4.7% during the September quarter, bringing the median dwelling value to $797,184 and placing it ahead of Melbourne.

In terms of rentals, a furnished 85m2 apartment in an expensive area of Perth will set you back roughly AU$3,994 per month, plus an extra AU$261 for utilities for two.

To help combat the cost of living in Perth and the rest of the state, the WA government’s 2024-25 State Budget will provide $762 million in cost of living support for families, including a new $400 Household Electricity Credit.

You might also be interested in: First home buyer grants and concessions in Western Australia

Darwin

Property prices in Darwin eased 0.7% during the September quarter, with a median dwelling value of $492,332. This makes Darwin the most affordable capital to buy in Australia.

Not to mention, a furnished 85m2 apartment in an expensive area of Darwin will set you back roughly AU$2,726 per month in rent and AU$355 for utilities, making it one of the least expensive capitals to rent in.

Despite offering more affordable housing options, the NT government is doing what it can to help residents with cost of living pressures through a range of concessions, subsidies and incentives.

You might also be interested in: First home buyer grants and concessions in the Northern Territory

Adelaide

With dwelling prices rising by 4.0% during the September quarter, Adelaide continues to perform well. The median dwelling value is sitting at $802,075.

A furnished 85m2 apartment in an expensive area of Adelaide will set you back roughly AU$3,275 per month in rent and an extra AU$415 for utilities for two people.

The SA government is investing $266.2 million to provide relief for the increasing cost of living for South Australians.

You might also be interested in: First home buyer grants and concessions in South Australia

Hobart

As the second most affordable capital to buy, dwelling values in Hobart have experienced a slight decline in the last quarter, with the median dwelling value currently coming in around $654,302.

A furnished 85m2 apartment in an expensive area of Hobart will set you back roughly AU$3,091 per month in rent, with utilities coming in at around AU$177 for two people.

In Tasmania, the government is offering an Energy Bill Relief Fund to provide lower energy bills for eligible residents.

You might also be interested in: First home buyer grants and concessions in Tasmania

Tips for combatting the cost of living with your mortgage

If you’re feeling the pinch, you might be wondering what you can do to help take the pressure off your finances. Here are a few key tips to help you cut back on your spending:

Consolidate your debt: If you’re juggling multiple loans, including personal loans, credit cards and even a mortgage, it could be worth consolidating your debts into a single loan. Not only does this help to streamline your repayments, but it can also help to lower your overall interest rate.

Negotiate your interest rates: If you’ve got a good credit score and a history of on-time mortgage repayments, you might be able to negotiate your interest rate with your current lender. This can help you to save on your interest repayments and pay off your home sooner.

Refinance: If your current lender isn’t willing to budget on your interest rate, it could be time to look elsewhere. By refinancing your home loan, you could secure a lower interest rate, helping you to save over the life of your loan. Just be sure to consider the cost of refinancing before you make the switch.

Whether you’re looking to compare interest rates or refinance your home loan, your local Aussie Broker can help make it happen. Book a free^ appointment with one of our expert brokers to see how we can help you save on your mortgage.