Borrowers on fixed rate mortgages should start preparing for higher interest rates once their fixed term ends, according to Aussie and CoreLogic data compiled in our ‘Your Next Mortgage Move’ Report for 2022.

Aussie and CoreLogic have teamed up to provide insights into the current property market with the goal of helping you figure out the next steps for your mortgage.

2022 has brought about a lot of changes to the economy, with home loans quickly becoming more expensive after two years of low interest rates.

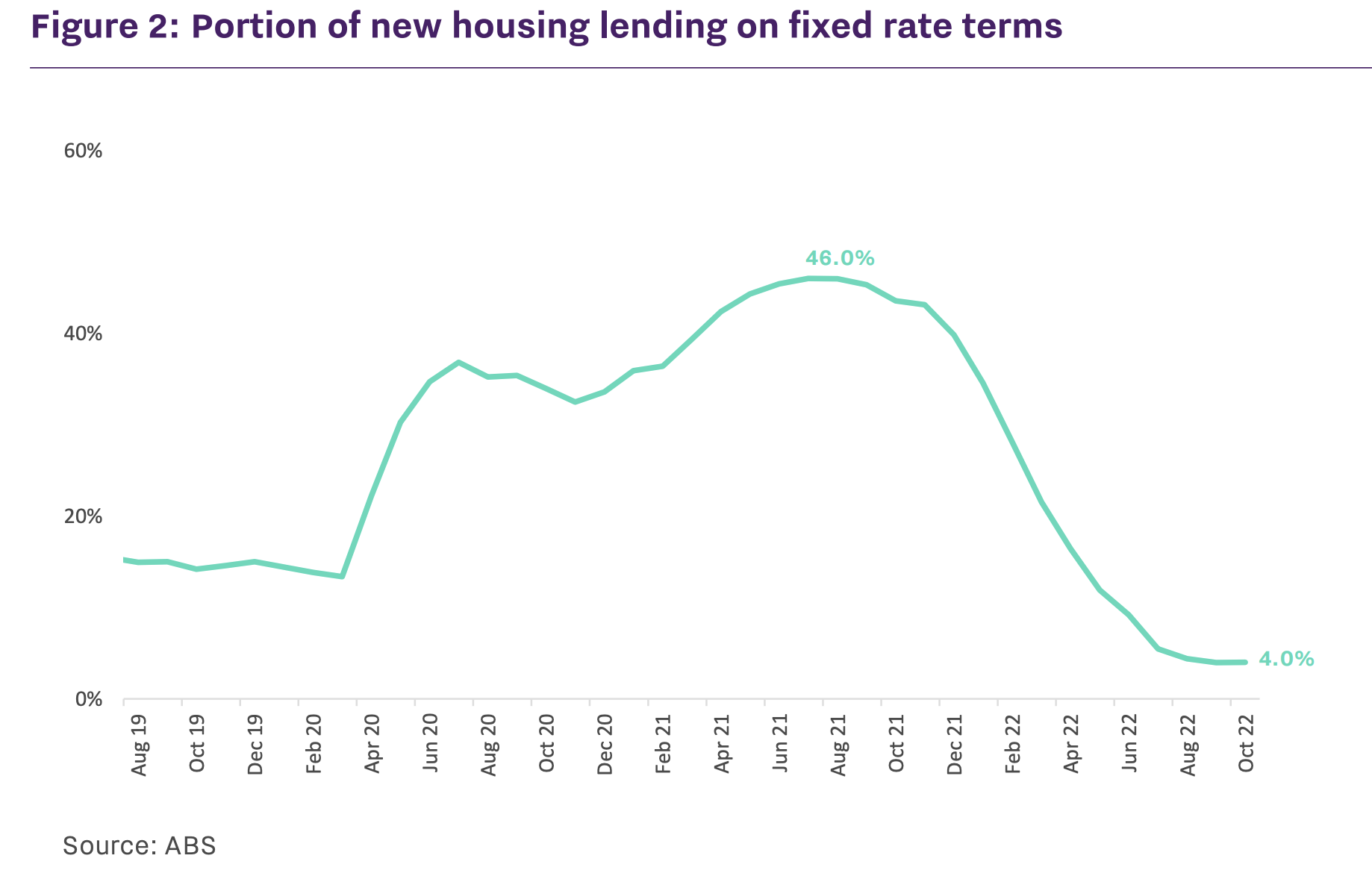

When interest rates hit record lows during 2020 and 2021, fixed rate home loans proved to be unusually popular.

Prior to 2020, fixed rate mortgages typically made up only around 20% of total mortgages. The cheap interest rates that followed the onset of the pandemic boosted the popularity of fixed rate home loan borrowing, which peaked at 46% in July 2021.

Cheap rates through the pandemic created a rare period in which fixed rate borrowing ballooned, with total housing lending and refinancing on set interest rates peaking at 46% in July 2021.

Two thirds of these fixed rate loans that were taken out are expected to expire during 2023, according to a recent Reserve Bank of Australia’s (RBA) Financial Stability Review.This means that these borrowers are likely to experience a significant increase in their home loan repayments.

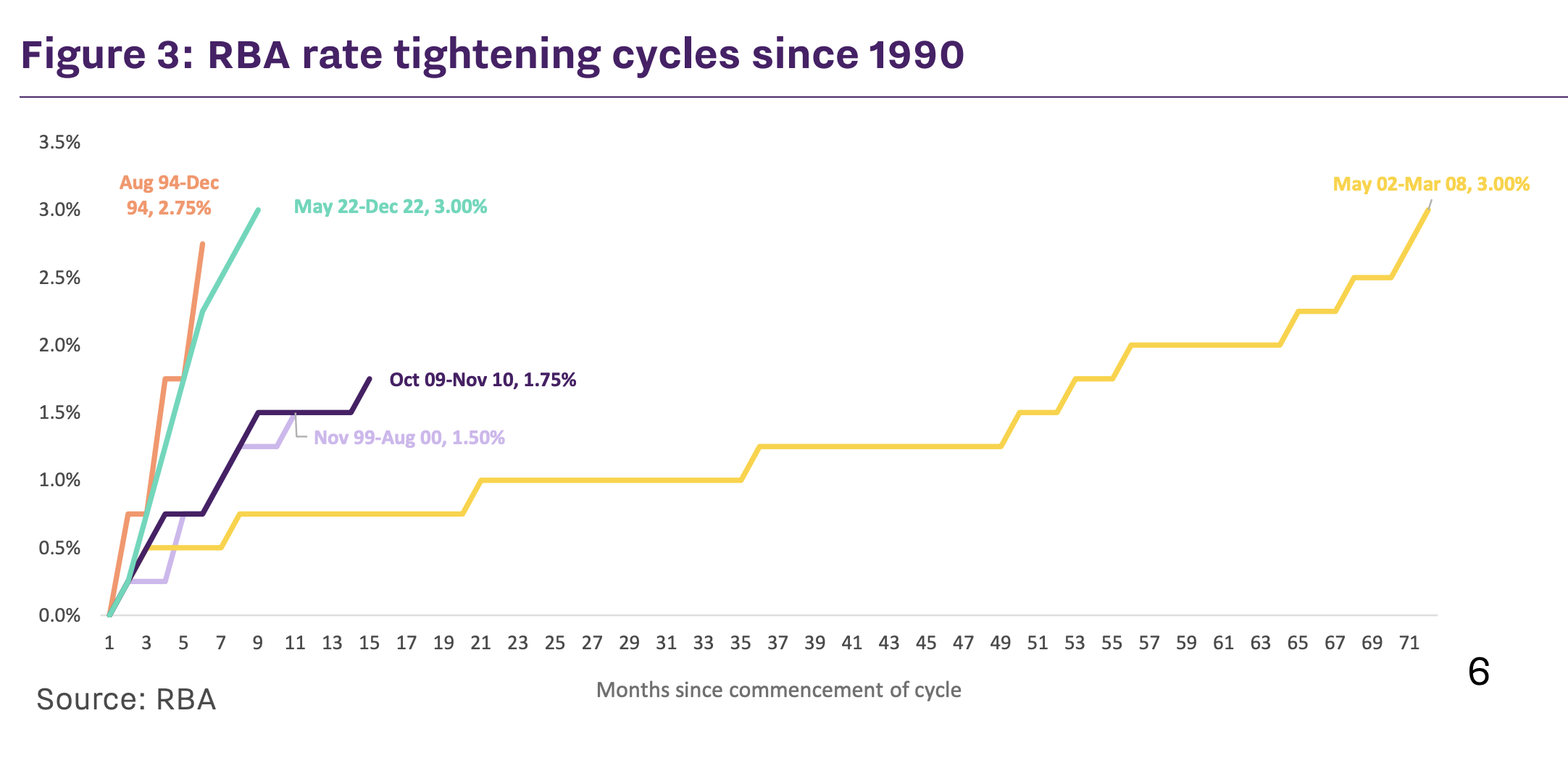

The cash rate, which is set by the RBA, has steadily increased by 300 basis points in just 8 months – capping off at 3.1% in December 2022.

As a result, the cost of debt has soared. The cash rate helps dictate the interest rates lenders charge on their loans and credit products. Lenders will charge an interest rate that covers their own cost of borrowing, business costs, as well as enough to make a profit.

For variable rate borrowers, the average home loan interest rate is about 5.08% throughout December.

How much will borrowers pay when their fixed rate expires in 2023?

Borrowers with a fixed rate expiring in 2023 are predicted to see their interest increase by around 3-4 percentage points.

The ‘Your Next Mortgage Move’ Report for 2022 highlights that high inflation is largely the reason for rates rising so rapidly. By increasing the cash rate (and, in turn, interest rates), the RBA hopes to reduce the risk of long-term high inflation and unemployment.

On December 6th, the RBA increased the cash rate by another 25 basis points (to 3.1%), taking the cash rate 300 basis points higher in eight months, which is highly unusual. In fact, it marks the steepest increase in the cost of debt since the 1990s, when the RBA first started setting the cash rate.

Even though these rate increases are likely to benefit Australia’s economy in the long run, it can be challenging for mortgage borrowers – especially those with a soon-expiring fixed rate loan who will be in for a dramatic increase in their home loan repayments.

How will higher interest rates affect borrowers?

Those with variable rate home loans are likely already used to the continuously increasing cash rate, but it’s fixed rate borrowers who could be in for a shock once their rate expires.

If you don’t refinance, your fixed rate loan will typically revert back to your lender’s standard variable rate at the end of the fixed period or even a slightly higher variable rate.

Even if you switch to a better rate, you’re still probably going to be paying more for your home loan repayments than you used to.

Luckily many borrowers may be ahead on their home loan repayments, having a nice cushion to fall back on as rates rise. This is partly because borrowers added a record $50 billion to their offset accounts over 2020 and 2021, while others made extra repayments or increased their monthly repayment amount.

This put the average borrower 45 months ahead of their mortgage repayments, according to data released by the Australian Prudential Regulation Authority (APRA) in January 2022.

However, not everyone is in this boat and regardless – such increased interest rates are still a lot to adjust to financially.

Borrowers who are unprepared for higher interest rates or those with higher debt-to-income ratios are more likely to be negatively impacted by the rate hikes.

Mortgage stress is often caused when a borrower spends over 30% of their household’s pre-tax income on mortgage repayments.

There is an increased risk of falling behind on repayments, or even mortgage defaults. Mortgage stress can even impact the personal life, physical and mental health of the borrower if not handled well.

If you are experiencing mortgage stress or are at risk of falling behind on your repayments, get in touch with your lender’s hardship team. Read our guide on mortgage stress to learn more about what to do if you’re experiencing it.

How can refinancing help?

Being prepared for your fixed rate’s expiration date is important, so it may be worthwhile to come up with a plan.

Refinancing can help fixed rate borrowers have more control over their expiring home loan rate. When you refinance, you can change the terms, structure and interest rate of your mortgage.

It also gives you the chance to look elsewhere for more competitive deals. In fact, it’s becoming more popular to switch lenders, according to ABS data that indicates that $17.8 billion in home loans was ‘externally’ refinanced in October 2022.

It may be better to wait until your fixed rate has expired before refinancing, as you could be charged break costs for refinancing before your fixed term is over.

It’s also important to remember that your home loan is more than just an interest rate. Consider what you need in a home loan (e.g. loan features, low fees, specific repayment structures) and don’t solely focus on the interest rate.

If you’re interested in refinancing, it’s a good idea to speak to your local Aussie Broker. They’ll get to know you and your mortgage needs so that they can tell you more about your home loan options.

How to manage higher interest rates

Higher interest rates equal higher mortgage repayments, so it can be a significant financial adjustment for borrowers of all income levels.

Here are some tips for dealing with higher interest rates and increased repayments:

Prepare for the end of your fixed rate: know when your fixed rate is expiring and figure out what your next moves are.

Review your budget and current spending: if your repayments are increasing, it’s time to assess your budget and see what you can change to improve your financial situation. Maybe you need to cut out certain ‘unnecessary’ expenses – even if temporarily.

Seek help when needed: if you’re struggling with your repayments, speak to your lender’s hardship team before the situation worsens. You can also speak to a financial counsellor for free.

Get a better deal: do some research and if your new higher interest rate isn’t very competitive, call up your lender and ask for a better deal. If they won’t budge, don’t be afraid to consider switching to a new lender.

Interested in refinancing? Whether you want a new lender or just a better interest rate, our Aussie Brokers are here to chat to you about your mortgage options. Book a free appointment today to learn more.

And if you’re still keen to learn more about the state of the property market and home loans in Australia, don’t forget to read the ‘Your Next Mortgage Move’ Report.