A million bucks. It doesn’t buy what it used to, that’s for sure. Especially when it comes to property. Here’s what the magic million will buy you these days in NSW and the ACT.

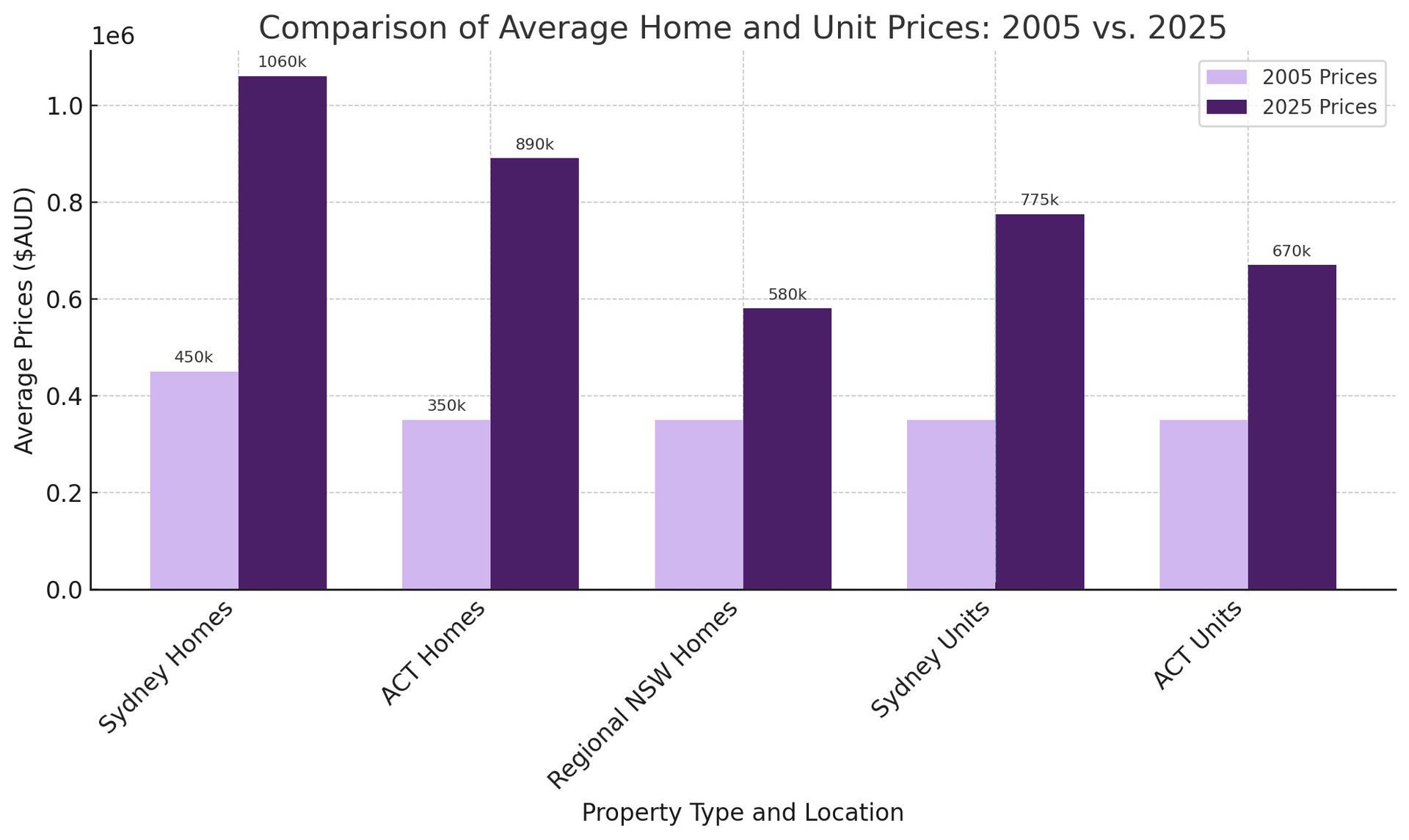

Average 2005 home and unit prices compared to average 2025 home and unit prices.

What does $1 million buy you in 2025 compared to 2005?

$1 million today and $1 million in 2005 are two very different numbers, believe it or not.

Adjusted for inflation, $1 million in 2005 actually has the buying power of over $1.6 million in 2025 (source: RBA inflation calculator). Put another way, if you have $1 million in 2025, that would have had the buying power of $625,000 in 2005 (Source: RBA inflation calculator).

On top of inflation, property prices have also been on a runaway tear for the last two decades. Especially in NSW and the ACT.

20 years ago, the median house price in Sydney was roughly between $400,000 and $500,000 (Source: RBA).

These days, the median house price is $1.06 million, meaning your million bucks won’t actually put you over the top and into a home.

To understand the value of $1 million today, let’s rewind two decades.

The ACT has gone wild, too: 20 years ago a house would set you back between $300,000 and $400,000. These days, that’s $890,000 (Source: ABS).

Even regional NSW is getting in on the action as demand from those looking to move out of expensive cities increases. $250,000 could put you in a home in regional NSW in 2005. Now it’s more than double that, at close to $580,000 on average.

How have median unit/apartment prices changed in 20 years?

Units have typically been what you buy when you can’t afford a home and just want to get on the property ladder. Again, it’s harder to do these days as the median unit price around the state has increased much faster than wage growth.

$300,000 would put you in a median unit in Sydney circa 2005. Now it’s closer to $775,000 (Source: ABS).

Canberra, again, is similar: $200,000 would get you a unit in 2005, but now it’s more than tripled to around $670,000 (Source: ABS).

How did property prices get so out of control?

House prices in NSW have blown up over the past two decades for a few reasons. It’s almost the perfect storm to drive price growth out of control. In short, it’s a storm of more people and fewer houses. Or as the experts put it, a “supply problem” in the wake of rising and rising demand.

Population growth has contributed to the demand side. Less available land, zoning restrictions and new infrastructure like the metro and new motorways driving people to new suburbs has also contributed to runaway price growth.

The availability of cheap loans due to low interest rates in the 2010s meant that more people got into the market, driving further demand and price spikes.

Then there’s the lifestyle shift post-COVID driving prices up in regional areas and in areas where space is more abundant.

When you put it together, that’s how you get a runaway house price trend as demand for housing outweighs supply of new housing in the eastern states.

Beyond the sticker price: breaking down the cost of buying

When you see the price of a property on a listing, you need to understand that there are costs over and above that.

When budgeting for a $1 million property, for example, you should factor in:

Stamp Duty: Around $40,000–$50,000 in NSW, depending on exemptions.

Legal Fees: $2,000–$5,000.

Lender’s Mortgage Insurance (LMI): If your deposit is less than 20% (it doesn’t always have to be!), you’ll need to budget for this. For a $1 million property, LMI can exceed $20,000.

Building and Pest Inspections: $500–$1,000.

All up, buyers should expect to spend at least an additional 5–7% of the property’s purchase price on fees and charges (Sources: ABS, RBA).

What does $1 million buy you in Sydney?

In Sydney, $1 million is the entry ticket to a modest home in the outer suburbs or a mid-range unit closer to the city. For example:

House: A three-bedroom home in Blacktown, Campbelltown, or Penrith. These properties typically feature basic amenities, smaller yards, and limited scope for expansion.

Unit: A two-bedroom apartment in Parramatta, Ryde, or Canterbury-Bankstown. Expect a modern build, but space will be at a premium.

In more central suburbs, $1 million won’t stretch far. You’re likely looking at older units or apartments in need of renovation.

Looking for a mortgage broker in Sydney? Get in touch to discuss your options today.

What does $1 million buy you in Canberra?

Canberra’s property market offers slightly better value for money. Here, $1 million can buy:

House: A modern four-bedroom home in suburbs like Gungahlin or Tuggeranong, with room for a backyard and updated interiors.

Unit: A high-end apartment in the city centre or Kingston, featuring two or three bedrooms, parking, and access to amenities like gyms or pools.

While Canberra is pricier than it used to be, the city’s planned growth and infrastructure investments make it a stable market for buyers.

What does $1 million buy you in Regional NSW?

If you’re after space and lifestyle, regional NSW delivers exceptional bang for your buck. With $1 million, you could buy:

House: A large family home on acreage in places like Orange, Dubbo, or Tamworth. These properties often come with expansive gardens, multiple living spaces, and even swimming pools.

Unit: In coastal hubs like Newcastle or Wollongong, $1 million could secure a three-bedroom waterfront apartment with modern finishes and scenic views.

Regional areas are ideal for families or those working remotely, offering a slower pace of life without sacrificing quality.

Where does $1 million go the furthest?

If stretching your dollar is the goal, these suburbs and towns deliver serious value:

Western Sydney: Areas like Penrith and Campbelltown offer family-friendly homes with access to schools and transport.

Canberra’s Outer Suburbs: Gungahlin and Belconnen deliver modern homes with community amenities.

Central Coast: Suburbs like Wyong and Gosford combine lifestyle with affordability.

Regional NSW: Cities like Bathurst and Albury offer high-quality homes at prices well below Sydney’s median.

Do you really need a 20% deposit?

To secure a $1 million property, you’ll need a deposit of $200,000 for the traditional 20%. If that feels out of reach, you can talk to one of our brokers about your low-deposit options.

Aussie brokers can also help you out with your LMI options, and point you in the direction of government assistance that may be available to you.