The COVID-19 pandemic signalled many shifts in the Australian property market and changed how people handled their home loans.

While the cash rate prior to the pandemic was relatively low, averaging around 2.55% over the previous decade, the Reserve Bank of Australia (RBA) set an even lower cash rate target.

You might also like: Does RBA influence interest rates?

From March 2020, the cash rate started to fall before eventually bottoming out at 0.10% in November 2020 – a record low rate that remained until May 2022. The lowering of the cash rate was done to encourage the flow of credit throughout the struggling Australian economy.

Lenders generally passed along these rates to their borrowers, meaning that interest rates for home loans and under credit products dropped.

What happened as a result of these ultra-low rates was an unprecedented rise in fixed rate mortgages, according to recent data from the Aussie and CoreLogic ‘Your Next Mortgage Move’ report.

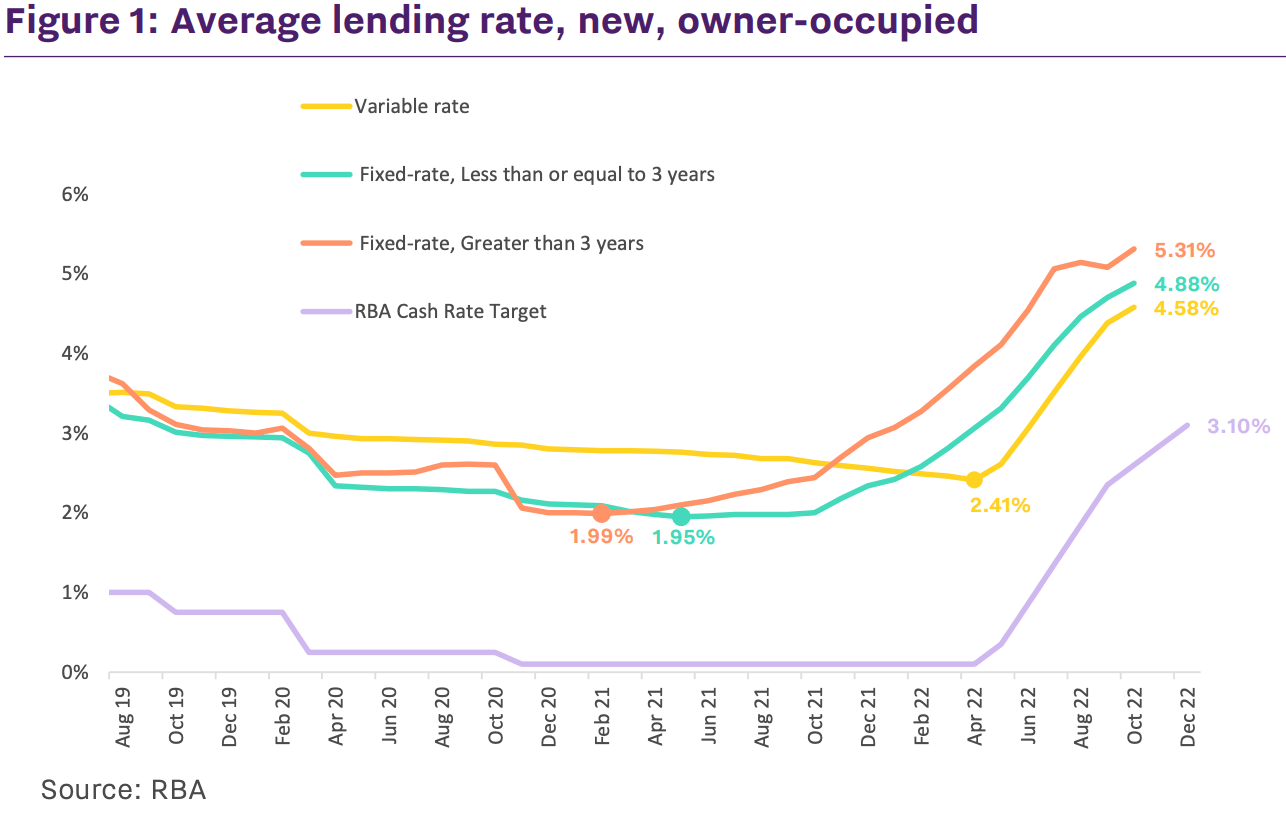

The figure below, which is featured in the report, shows the average new home loan rates for owner-occupier loans by type (i.e. variable, fixed rate with a term equal or less than 3 years and fixed rate with a term greater than 3 years).

The data points to a lot of interesting – and sometimes unusual – trends. For example, it is unusual for average fixed rates to be low relative to variable rates.

Yet the affordability of fixed rates during the bulk of the pandemic made them an attractive option for borrowers wanting to ‘lock in’ a lower interest rate for a few years.

Average fixed interest home loan rates with a set term of up to 3 years went as low as 1.95% in May 2021. While fixed rate loans with a term of 3+ years are going to have higher rates on average, they still went as low as 1.99% on average in February 2021.

You might also like: Can refinancing your home loan help you save?

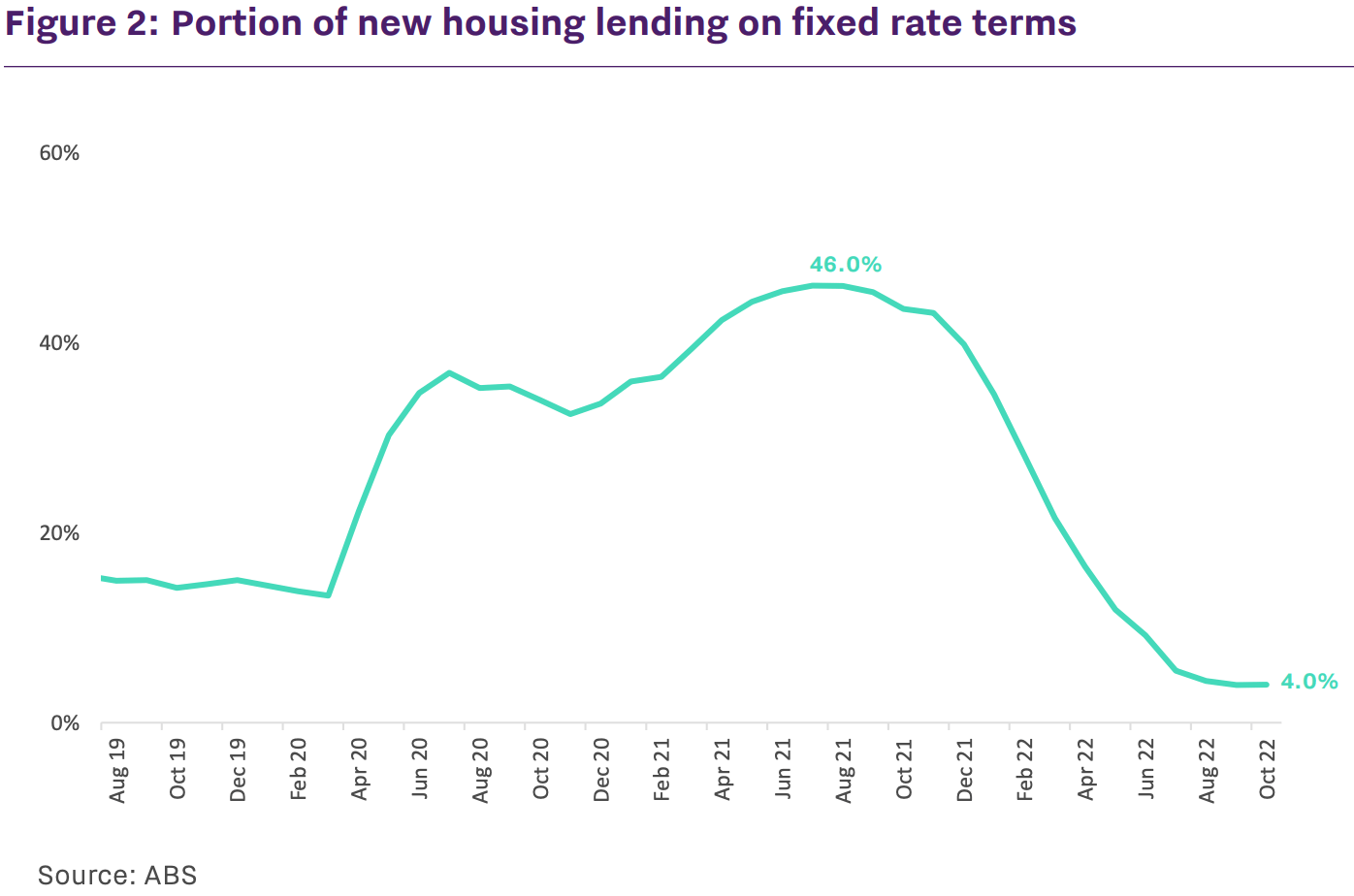

So naturally, these unusually low fixed rates led to a rare boom in fixed rate borrowing. The total mortgage lending and refinancing on fixed rates peaked at 46% in July 2021.

Previously fixed rate borrowing was much less common – hovering around the 20% mark in recent years.

The figure below from the Aussie and CoreLogic ‘Your Next Mortgage Move’ report shows the portion of new housing home loans going on fixed interest rates.

You will notice the obvious decline in borrowers opting for a fixed rate in the new loan from around October 2021. This was around the time that rumours about cash rate increases early in 2022 started to swell and so lenders started to increase their fixed rates.

If you refer to the previous graph, you’ll notice a fairly clear spike in the average fixed interest rate – for both shorter and longer terms – at this time.

Once the cash rate did rise in May 2022, fixed rate borrowing just continued to decline. By October 2022, fixed rate home loans accounted for just 4% of new housing lending in October 2022.

You might also like: 30 years of property trends

Following unusual popularity in fixed term mortgages, variable rate home loans have reverted to being the more popular choice for borrowers taking out new loans. According to data shared in Figure 1, the average variable rate has returned to being lower than average fixed rates.

Many of the borrowers who took advantage of the low fixed rates during 2020 and 2021 are still benefitting from them. However, it’s likely that many of these fixed terms are set to expire in 2023.

This means that these borrowers will have to deal with significantly higher home loan repayments due to higher interest rates.

If you are moving towards the end of your fixed rate, it’s important to be prepared and know what to expect. Read our article about avoiding the pressure of the ‘rate cliff’ as your fixed term ends.

Want to refinance your home loan or find out more about your mortgage options? Book a free appointment with your local Aussie Broker to learn more.