After a series of rapid rate hikes, Australians are watching closely to see when the Reserve Bank of Australia (RBA) might finally ease up.

Interest rates affect everything from mortgage repayments to savings accounts and borrowing costs. So, if you're hoping for a break, you're in the right place. With a massive retail and mobile broker network under our belt, we keep a close eye on every move from the RBA—so you don’t have to.

Here’s what we know about when rates might come down.

Where is the RBA cash rate at right now?

As of the last RBA meeting in December 2024, the official cash rate stands at 4.35%, following multiple rate hikes since 2022.

Rates have been holding at 4.35% since November 2023, after a 0.25% increase from 4.10% in the prior meeting.

The RBA has been laser-focused on controlling inflation, but with pricing pressures easing, the conversation is shifting: when will rates start to come down?

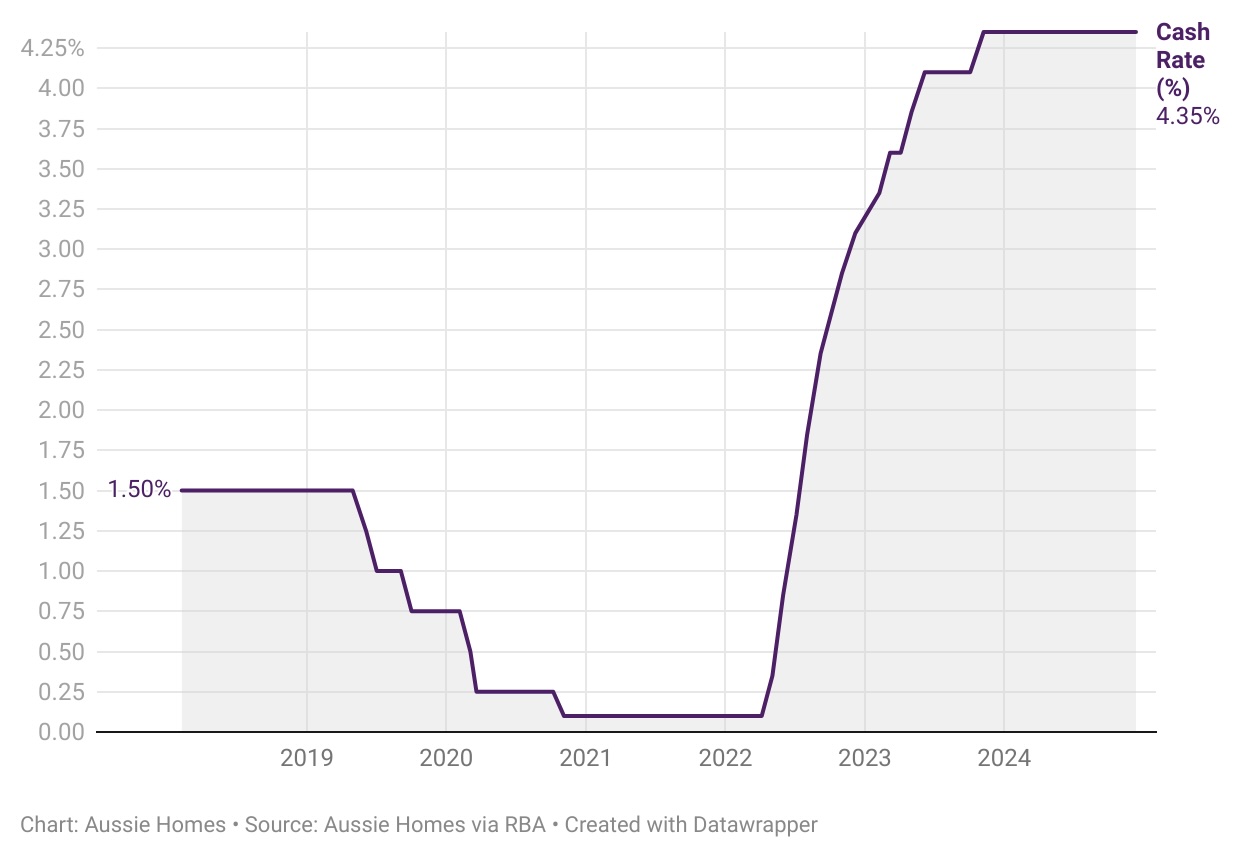

A look at how the Australian cash rate has changed over the last six years

Since 2018, interest rates have moved from 1.50% to their current level of 4.35%.

Why has the RBA kept rates so high for so long?

The RBA watches more than just interest rates. It’s keeping tabs on the entire global economy and how it affects Australia.

A few key reasons why rates have been left high for a while - especially as other nations cut rates - include:

Inflation – The word you never wish you needed to know about. Inflation exploded post-COVID, and the RBA by controlling interest rates aimed to bring inflation back to its target range of 2-3%. While the headline inflation rate has decreased to 2.4% in January 2025, the RBA instead goes by the trimmed mean inflation, which excludes the most volatile price changes to provide a clearer view of underlying inflation trends. As of January 2025, the trimmed mean inflation stands at 3.2%, still above the target range. It’s why some are cautious to say there’s a 100% chance of a cut in the upcoming February RBA meeting.

Wages & Spending – Higher wages and strong consumer spending can put upward pressure on prices, contributing to - again - inflation. The RBA monitors these factors closely to assess their impact on inflation dynamics.

Global Trends – Central banks worldwide, including the US Federal Reserve, have maintained higher interest rates to control inflation. The RBA monitors global movements to ensure Australia's monetary policy remains aligned and effective.

The (mostly) good news is that inflation is slowly but surely coming back down to earth. The chance of rate cuts in February 2025 were watered down by many experts towards the end of 2024. But with recent economic data looking rosier than expected, we might be in luck.

Will RBA cut rates in February 2025?

So, will there be rate cuts in February 2025? The experts can confidently say: “Definitely, maybe”.

The December quarter saw annual inflation drop to 2.4%, within the RBA's target range of 2-3%. The real number the RBA watches, however is the trimmed mean, which puts inflation still at 3.2%, which is still a smidge too high for the RBA Board.

Regardless, the hype is here for rate cuts. Here’s what the experts have said in light of the new data:

National Australia Bank (NAB): NAB Economics has updated its forecast, now expecting the RBA to cut the cash rate by 25 basis points in February. NAB Group Chief Economist Alan Oster stated, "Inflation easing more quickly than the RBA expected has set the scene for a February cut to the cash rate."

Westpac: Economists at Westpac suggest that the RBA should have enough confidence to start cutting the cash rate at its February meeting, citing cooling inflation as a key factor.

Reuters Poll: A Reuters poll indicates that 68% of economists anticipate a 25 basis point reduction in the cash rate in February 2025, with projections of a total 75 basis point decrease by the end of 2025.

Deloitte Access Economics: While acknowledging the recent decline in inflation, Deloitte's Stephen Smith notes that factors such as a strong job market and high government spending may lead the RBA to delay rate cuts. He predicts the cash rate could drop from 4.35% to 2.85% by the end of 2025, however, suggesting a more gradual easing over time.

See? Definitely, maybe.

How much could a rate cut save you?

Let’s do some maths, but remember: your individual circumstances may vary to the average Australian. One of our brokers can chat with you for more tailored advice, free of charge.

For existing homeowners

As of November 2024, the average variable mortgage rate for owner-occupiers is 6.11%. And according to the ABS around the same time, the average owner-occupier is currently carrying $615,000 on their mortgage. That makes the average mortgage around $3726 a month in Australia.

If the RBA blesses the nation with an interest rate cut in February 2025 of 0.25%, that average variable mortgage rate would start with a welcoming 5, at 5.86% or around $96 a month back in your pocket. That puts a trip to the movies or potentially a monthly date night back on the agenda!

Alternatively, if you add it up, it’s just shy of $1200 a year. That’s enough to get yourself the new iPhone this time next year, for example, and stop using the one you have with the broken screen and terrible battery. Thanks, Governor Bullock.

For First-Home Buyers and upgraders

A lower interest rate means first home-buyers could see the amount of money they can borrow (also known as borrowing power) increase. If 0.25% is carved off the top of mortgage rates, it equates to around $13,000 more being added to the average Australian first home-buyer’s borrowing power.

In cities like Sydney and Melbourne, this additional borrowing capacity could be the difference between purchasing a one-bedroom versus a two-bedroom apartment. At the very least it could help pay for some new furniture come move-in day for lucky first-home buyers.

For property investors

A rate cut means lower outgoings on investment properties, enhancing cash flow.

Historically, lower rates have also triggered a surge in property demand, potentially leading to another property boom.

What can you do right now for lower mortgage payments?

Reducing your mortgage payments doesn't have to wait for potential rate cuts. Here are some proactive steps you can take right now to ease your financial load:

Negotiate a lower interest rate via one of our brokers – Reach out to your local Aussie broker and get them to help you see if you are able to secure a lower rate. Lenders often accommodate to retain good customers, and we always know the right people to speak to.

Consider refinancing your variable loan or move to fixed – If your current mortgage terms are no longer favourable, refinancing might be a viable option. By securing a lower interest rate or adjusting your loan term, you can reduce your monthly repayments. However, be mindful of potential fees and ensure the benefits outweigh the costs. A chat with one of our brokers can help spell it all out for you.