Most property buyers in Victoria will be subjected to paying stamp duty, otherwise known as transfer duty.

It will be a major upfront expense that you must consider when saving up a deposit, so it’s important to understand how it works and how much you could be charged.

In this article we’ll explain what stamp duty is, how it is calculated, how it works in Victoria and what concessions and exemptions may be available to home buyers.

UPDATE: Victoria is temporarily slashing stamp duty on off-the-plan apartments, units, and townhouses

This tax break is part of the state's plan to address the housing crisis and will be applicable for contracts signed between October 21, 2024 and June 30, 2025.

Previously, only first-home buyers and off-the-plan buyers purchasing homes below a certain price threshold were eligible for stamp duty concessions. However, the new stimulus plan extends these concessions to all buyers and developers for the next 12 months.

What is stamp duty?

Also known as transfer duty, stamp duty is a fee you pay to the government when purchasing land, property and some other assets. It’s a fee you pay to transfer ownership of the asset into your name.

Stamp duty is like a tax. The money it generates is put back into the economy by funding public sectors (e.g. education, roads and transport, healthcare, emergency services).

For properties, the rate of stamp duty varies between states and territories across Australia. It’s important to refer to information specific to the state where you will be purchasing property.

How is stamp duty calculated?

While the rates of stamp duty may differ across Australia, there are several common factors that influence it:

The value of the property or sale cost (whichever is higher)

The location of the property (which state/territory it is in)

The type of property (e.g. owner-occupied, investment property, whether the property is a unit or house)

Whether you are a first home buyer

Whether you are classed as a foreign buyer.

To get an idea of how much stamp duty you could be charged, check out Aussie’s Stamp Duty Calculator.

How does stamp duty work in Victoria?

Stamp duty is required to be paid to Victoria’s State Revenue Office within 30 days of the property sale being finalised and contracts have been completed.

It’s calculated based on the type and value of the property, while considering any concessions you may be eligible for. So, the more expensive the property you purchase, the more you’ll pay in transfer duty fees.

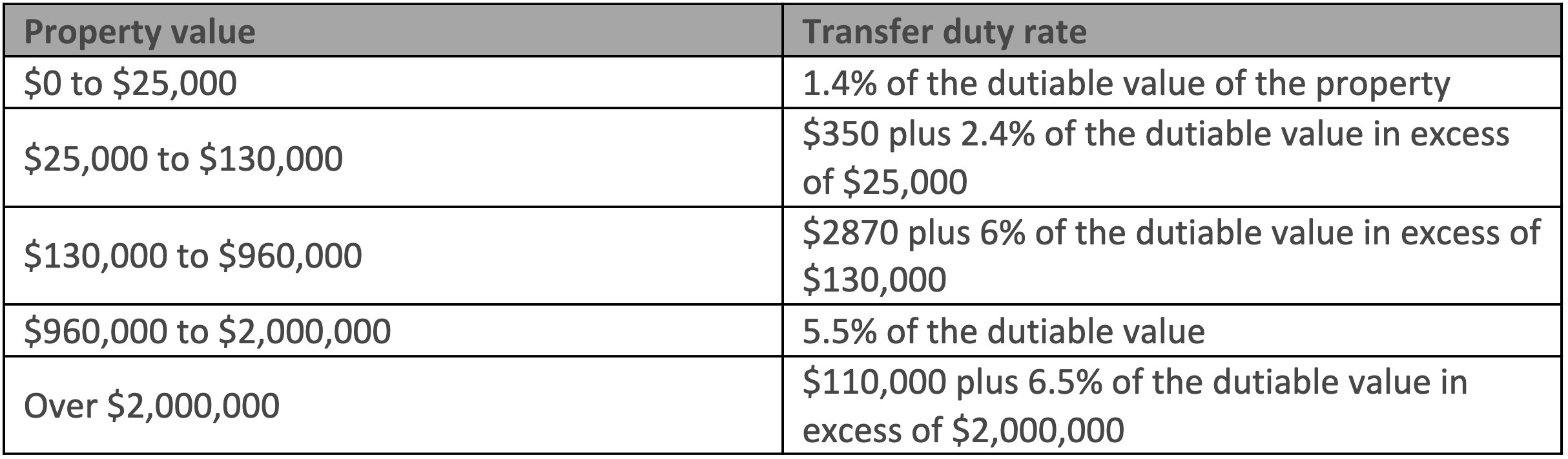

Here are the VIC stamp duty rates from 1 July 2021:

Do foreign buyers in VIC have to pay additional duty?

Foreign buyers in VIC may have to pay an additional duty amounting to 8% of the property’s value.

What stamp duty concessions and exemptions are available in VIC?

Victoria has a number of transfer duty discounts in place for different types of borrowers.

1. First home buyer duty exemption or concession

First home buyers may be eligible for a stamp duty exemption, concession or reduction.

Eligible buyers purchasing a home valued at $600,000 or less can receive a stamp duty exemption.

For buyers purchasing a home valued between $600,001 and $750,000, they can potentially get a concession on a sliding scale.

If you are purchasing a property valued over $750,000, you unfortunately will not be eligible for the first home buyer stamp duty concession.

To be eligible for this concession or exemption in Victoria, you must:

Be a first home buyer purchasing a home in Victoria

Move into the property within 12 months of ownership and reside there for 12 months straight

Purchase a home that falls within the previously mentioned property price bands.

If you are eligible for the first home buyer duty exemption or concession, you can still apply for the First Home Owner Grant – if you’re eligible.

If you’re buying or building a new home with a maximum value of $750,000, you may be eligible for the grant.

2. Principal Place of Residence (PPR) duty concession

This is a stamp duty concession available to homebuyers purchasing a property valued at or below $550,000.

Like the first home buyer concession, you have to move into the property within 12 months of settlement and reside there for at least 12 continuous months.

3. Pensioner duty discount

Pensioners and holders of concession cards may be eligible for this one-time stamp duty discount. A full exemption applies to properties valued up to $330,000. For properties less than $750,000, a concession may apply.

To be eligible, you must reside at the residence for at least 12 months. This concession can only be used once and not in conjunction with the first home buyer concession.

4. Off-the-plan duty concession

Buyers of off-the-plan properties may be eligible for a discount on stamp duty. You must live at the home for at least 12 continuous months within 12 months of settlement. You must also be eligible for either the PPR concession or the first home buyer concession.

The concession works quite differently to the other concessions available. Instead of using the purchase price/market value of the property or just the contract price, this concession calculates dutiable value as the contract price, while subtracting the construction costs that are incurred on or following the construction date. In turn, the amount of stamp duty you pay is reduced.

This concession is complicated to calculate, so it’s a good idea to consult the Victoria State Revenue Office website.

Want to get started on your home buying journey in Victoria? Find out what your home loan options could be by booking a free appointment with your local Aussie Broker.