When you buy property in Tasmania, it’s very likely that you will be charged stamp duty on the purchase.

This can be a hefty upfront fee, so it’s good to be across how it works. In this article we’ll explain exactly what stamp duty is, how it is calculated, as well as the concessions and exemptions that are available.

What is stamp duty?

Also known as transfer duty, stamp duty is a fee you pay to the government when purchasing land, property and some other assets. It’s a fee you pay to transfer ownership of the asset into your name.

Stamp duty is like a tax. The money it generates is put back into the economy by funding public sectors (e.g. education, roads and transport, healthcare, emergency services).

For properties, the rate of stamp duty varies between states and territories across Australia. It’s important to refer to information specific to the state where you will be purchasing property.

How is stamp duty calculated?

While the rates of stamp duty may differ across Australia, there are several common factors that influence it:

The value of the property or sale cost (whichever is higher)

The location of the property (which state/territory it is in)

The type of property (e.g. owner-occupied, investment property, whether the property is a unit or house)

Whether you are a first home buyer

Whether you are classed as a foreign buyer.

To get an idea of how much stamp duty you could be charged, check out Aussie’s Stamp Duty Calculator.

How does stamp duty work in Tasmania?

Stamp duty for properties purchased in Tasmania is paid to the Tasmanian Government Department of Treasury and Finance.

Once the property settlement occurs, you have 3 months to pay the stamp duty you owe.

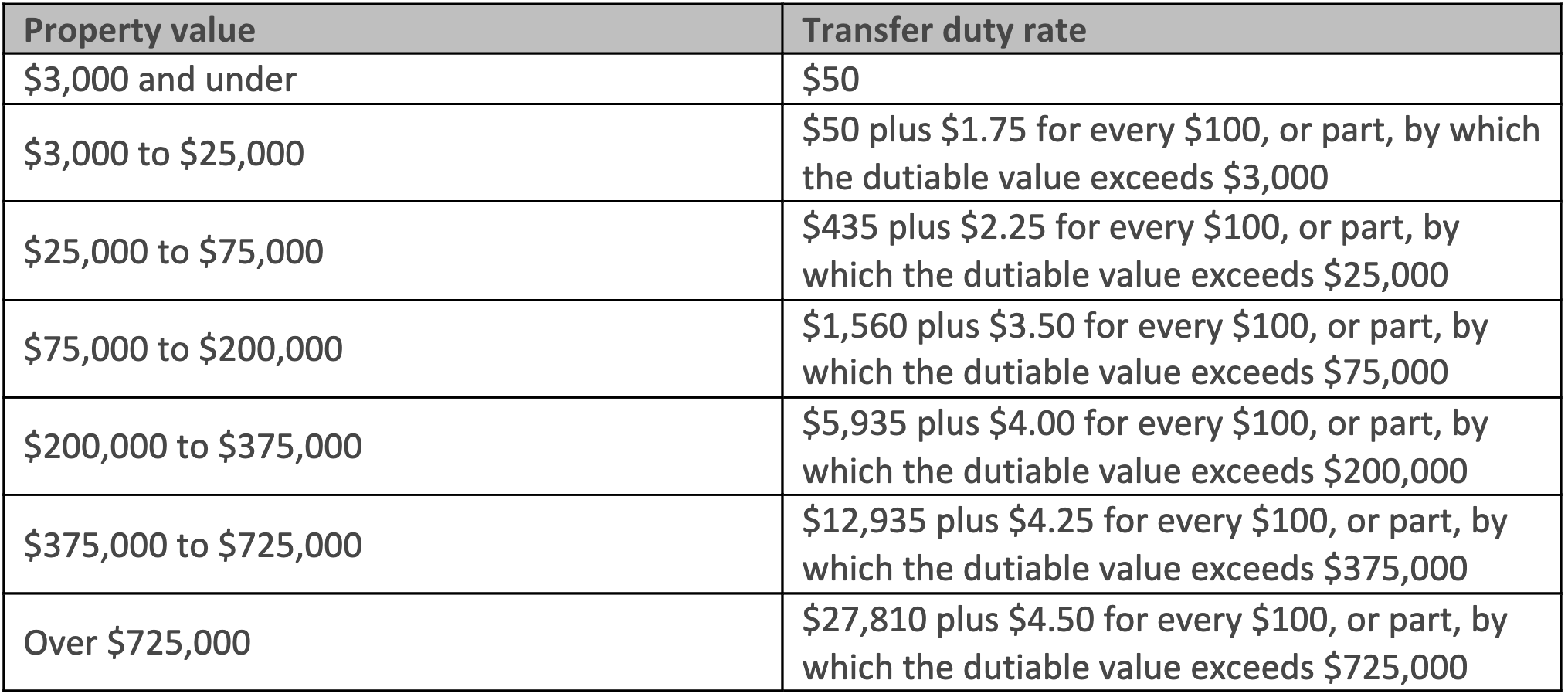

The rates of stamp duty in Tasmania are as follows:

Stamp duty rates: TASMANIA

Do foreign buyers in Tasmania have to pay additional duty?

Foreign buyers in Tasmania may have to pay an additional duty amounting to 8% of the property’s value.

What stamp duty concessions and exemptions are available in Tasmania?

Don’t forget to see if you’re eligible for a stamp duty concession if buying property in Tasmania.

1. First home buyers of established homes duty concession

For first home buyers of established homes in Tasmania, you may be eligible for a 50% discount if the property is valued at $600,000 or less.

As well as being a first home buyer, you must be an Australian citizen or permanent resident to apply and reside in the home for a continuous period of at least 6 months within 12 months of the property settlement.

This particular concession is for properties purchased between 1 January 2022 and 30 June 2023.

2. Pensioners downsizing to a new home duty concession

Pensioners who sell their existing home in Tasmania and purchase a new home (also in Tasmania) could be eligible for a 50% stamp duty discount on their new home. The concession applies to homes valued up to $600,000.

To be eligible, you must:

Be 60 years or older

Hold a Pensioner Concession Card, be a recipient of a DVA special rate pension, or be a holder of a Commonwealth Seniors Health Card.

Be an owner occupier of the previous property and be an owner occupier of the new purchase for at least 6 continuous months within 12 months of settlement.

Not own any other properties at the time of transaction – aside from the former home that you have sold/will be selling.

Not have previously received this concession in the past.

This concession is for properties purchased between 1 January 2022 and 30 June 2023.

3. Others

Typically, you won’t need to pay stamp duty in Tasmania if transferring property ownership from one family member to another. You are also exempt if transferring the property between former partners following a relationship breakdown.

Who is exempt from stamp duty in Tasmania?

There are certain kinds of buyers who may be exempt from paying stamp duty in Tasmania. Most notably, if you are transferring the property between partners in a marriage or those in a ‘significant relationship’, you may be exempt from paying stamp duty.

To be eligible for this exemption, the property in contention must be the principal place of residence for both parties at the time of the transfer. Additionally, both parties must hold the property as joint tenants or alternatively as tenants with equal shares.

Can I borrow money to cover stamp duty?

Stamp duty can be such a major expense to cover upfront, so some buyers may want to look into ways to borrow money to cover the cost.

In most cases, you won’t be able to take out a personal loan to cover the cost of stamp duty. However, if you’ve saved up a large home loan deposit, you may be able to shift funds from this over to your stamp duty.

Bear in mind that this will change your Loan to Value Ratio (LVR) as you’ll be required to borrow more money. If your deposit no longer covers 20% of the value of the property you’re purchasing, you may have to pay Lenders Mortgage Insurance (LMI).

Want to get started on your home buying journey in Tasmania? Find out what your home loan options could be by booking a free appointment with your local Aussie Broker.