When you buy property in the Australian Capital Territory (ACT), you’ll probably be charged stamp duty.

While the cost of stamp duty is dependent on the property’s value and some of your personal circumstances, it’s likely to be your largest upfront homebuying expense after the property deposit.

In this article we’ll explain what stamp duty is, how it’s calculated, how it works in the ACT and what concessions and exemptions may be on offer to eligible buyers.

What is stamp duty?

Also known as transfer duty, stamp duty is a fee you pay to the government when purchasing land, property and some other assets. It’s a fee you pay to transfer ownership of the asset into your name.

Stamp duty is like a tax. The money it generates is put back into the economy by funding public sectors (e.g. education, roads and transport, healthcare, emergency services).

For properties, the rate of stamp duty varies between states and territories across Australia. It’s important to refer to information specific to the state where you will be purchasing property.

How is stamp duty calculated?

While the rates of stamp duty may differ across Australia, there are several common factors that influence it:

The value of the property or sale cost (whichever is higher)

The location of the property (which state/territory it is in)

The type of property (e.g. owner-occupied, investment property, whether the property is a unit or house)

Whether you are a first home buyer

Whether you are classed as a foreign buyer.

To get an idea of how much stamp duty you could be charged, check out Aussie’s Stamp Duty Calculator.

How does stamp duty work in the ACT?

Stamp duty, or conveyance duty – as it is sometimes referred to in the Australian Capital Territory – is paid to the ACT Revenue Office. Home buyers in the ACT are required to pay stamp duty within 90 days of property settlement.

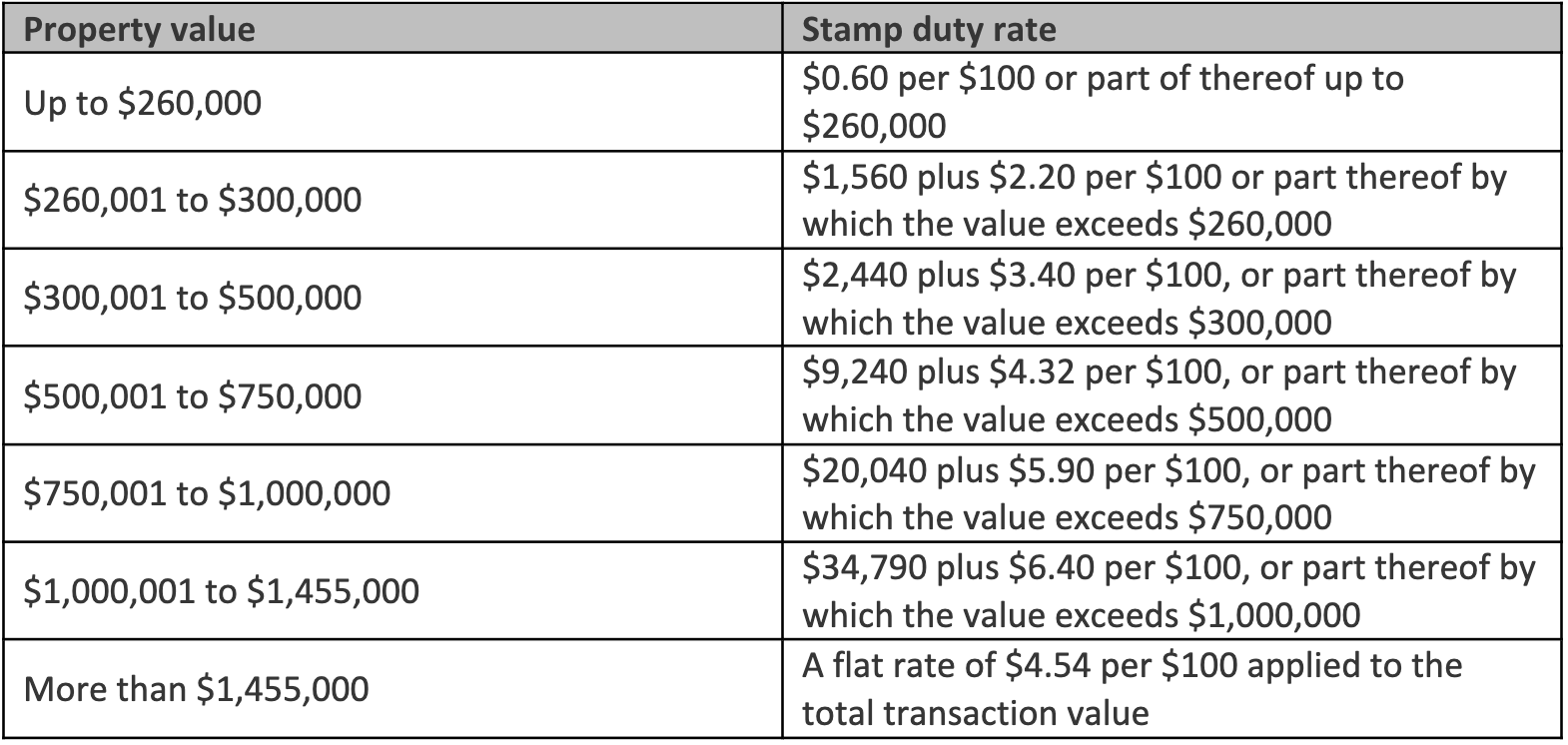

The rates of stamp duty in the ACT for owner occupiers are as follows:

ACT stamp duty rates - owner occupiers

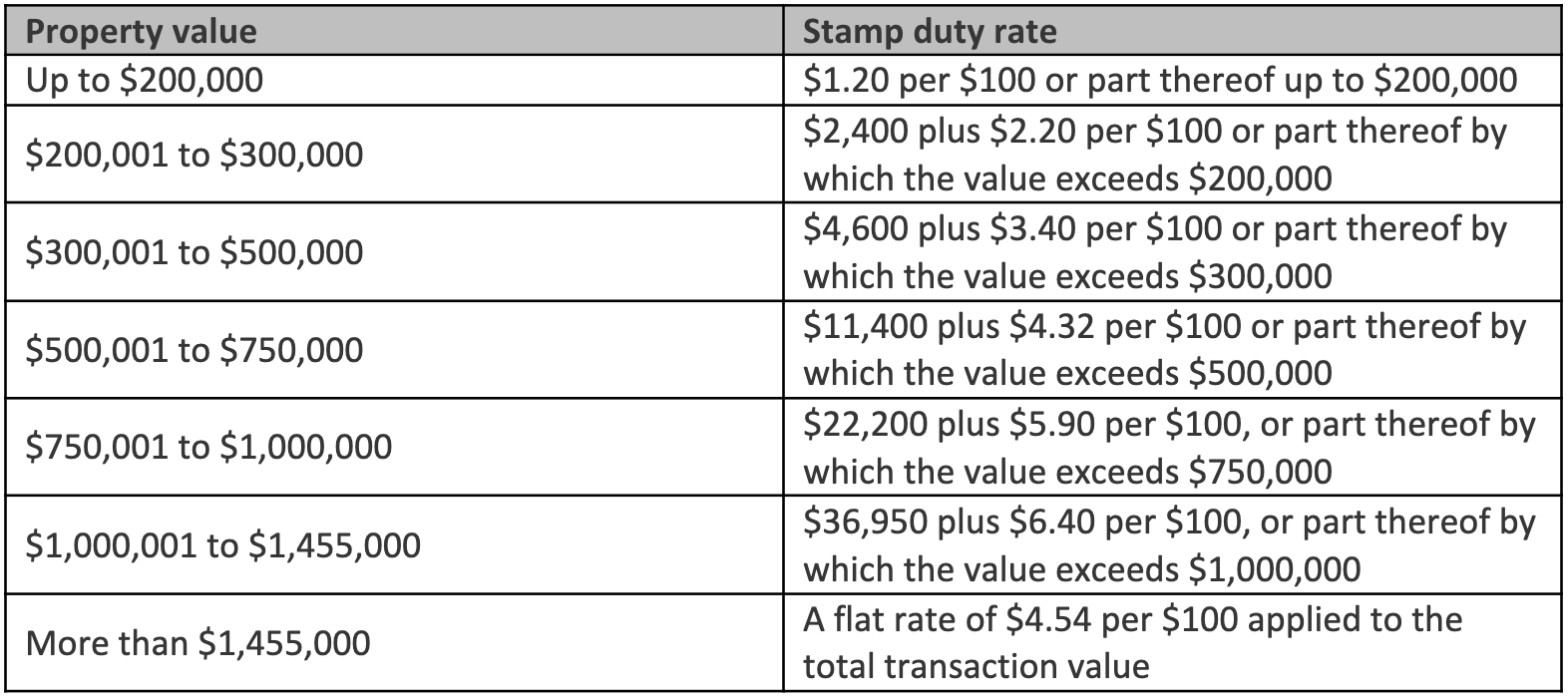

The rates of stamp duty in the ACT for property investors are as follows:

ACT stamp duty rates - property investors

Do foreign buyers in the ACT have to pay additional duty?

Foreign buyers in Tasmania may have to pay an annual land tax surcharge of 0.75% of the Average Unimproved Value of the land.

What stamp duty concessions and exemptions are available in the ACT?

From 1 April 2022, the ACT is offering a stamp duty concession on off-the-plan units and townhouses. If you purchase a unit or townhouse in the ACT valued at or below $600,000 you are exempt from stamp duty.

This concession is only for owner-occupiers, so you need to reside in the property to be eligible.

Like most other states and territories, the ACT does not charge stamp duty on deceased estates and matrimonial transfers.

Want to get started on your home buying journey in the ACT? Find out what your home loan options could be by booking a free appointment with your local Aussie Broker.