If you want to buy property in New South Wales, you’re probably going to have to pay stamp duty. Stamp duty is one of the largest upfront costs a home buyer will have other than the property deposit, so it’s important to be prepared.

In this article we’ll explain what stamp duty is, how it is calculated, how it works in NSW and what concessions and exemptions may be available. Stamp duty works quite differently in NSW as first home buyers can choose between paying it and paying an annual property tax.

What is stamp duty?

Also known as transfer duty, stamp duty is a fee you pay to the government when purchasing land, property and some other assets. It’s a fee you pay to transfer ownership of the asset into your name.

Stamp duty is like a tax. The money it generates is put back into the economy by funding public sectors (e.g. education, roads and transport, healthcare, emergency services).

For properties, the rate of stamp duty varies between states and territories across Australia. It’s important to refer to information specific to the state where you will be purchasing property.

How is stamp duty calculated?

While the rates of stamp duty may differ across Australia, there are several common factors that influence it:

The value of the property or sale cost (whichever is higher)

The location of the property (which state/territory it is in)

The type of property (e.g. owner-occupied, investment property, whether the property is a unit or house)

Whether you are a first home buyer

Whether you are classed as a foreign buyer.

To get an idea of how much stamp duty you could be charged, check out Aussie’s Stamp Duty Calculator.

How does stamp duty work in NSW?

In most cases, stamp duty must be paid to Revenue NSW within 3 months of signing a sale contract. However, buyers of off-the-plan homes who intend to reside in the property may be able to defer the payment of stamp duty for a maximum of 12 months.

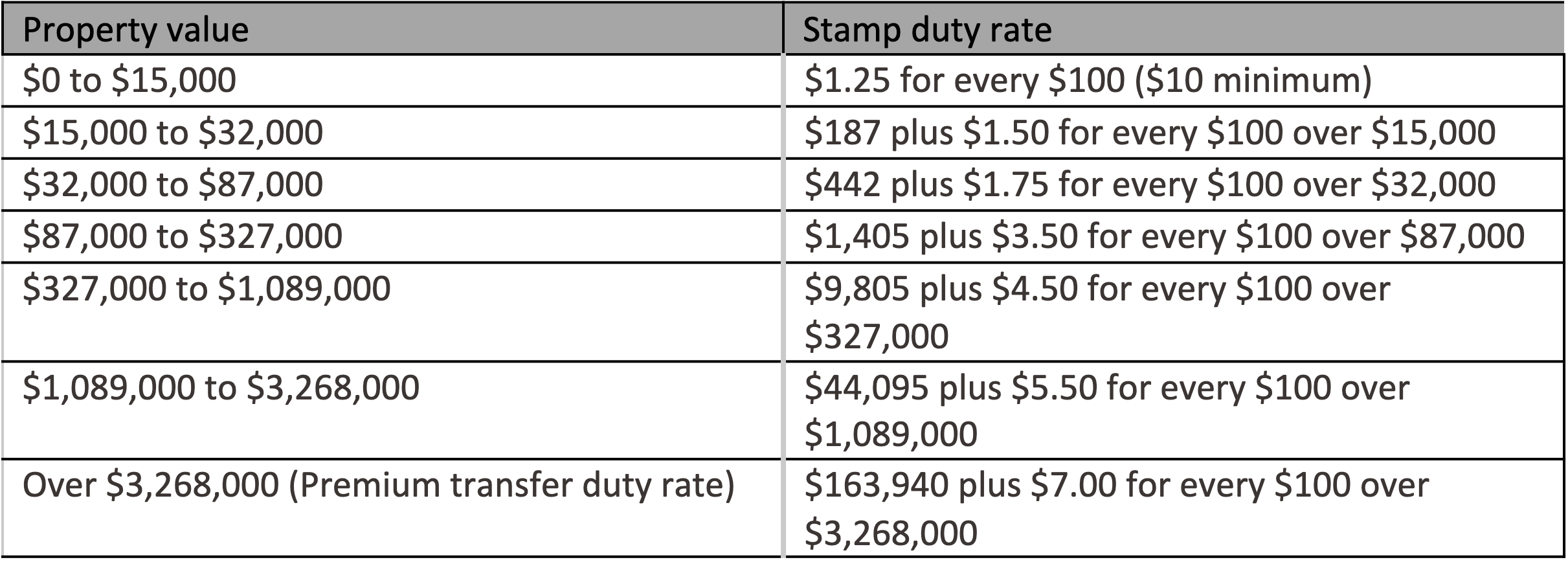

Here are the NSW transfer duty rates from 1 July 2022 onwards:

Do foreign buyers in NSW have to pay additional duty?

Foreign buyers in NSW may have to pay an additional duty amounting to 8% of the property’s value.

How is stamp duty changing in NSW?

First home buyers in NSW now get to choose between paying stamp duty or opting in to pay an annual property tax for however many years they own the property.

Known as First Home Buyer Choice, eligible first home buyers have lower upfront home-buying costs which could increase the rate of home ownership in NSW.

The property tax scheme is due to commence in 2023, with eligible first home buyers signing a contract of purchase on or after 16 January being able to apply.

It’s useful to mention that first home buyers can still just pay stamp duty if they prefer. When making your choice, think about how long you will likely remain in the property for.

For example, a buyer who sees them self owning their first home for less than 10 years may save more money by paying an annual property tax instead.

You can calculate your potential property tax here.

Am I better off paying stamp duty or a property tax?

The option that is better completely depends on your personal situation and how long you intend to own the home for.

If you’re planning on owning the home for around 10 years or less, you’ll probably save by paying the annual property tax. The tax rate could change though, so bear that in mind.

Additionally, another consideration will be whether you want to wait until you have saved up enough to cover stamp duty upfront, or whether it just makes more sense to buy now and pay an annual tax.

If you’re unsure, it’s always a good idea to seek professional advice from a financial advisor.

You might also be interested in: NSW pattern book launches with housing designs available for just $1

What stamp duty concessions and exemptions are available in NSW?

Another factor that could influence a first home buyer deciding between stamp duty and property tax is whether they are eligible for any concessions or exemptions.

The First Home Buyer Assistance scheme can help eligible first home buyers receive a discount or full exemption on paying stamp duty.

Here’s how it works:

New homes valued under $650,000: pay no stamp duty, apply for full exemption

New homes valued between $650,000 and $800,000: apply for a concessional stamp duty rate

Existing homes valued under $650,000: pay no stamp duty, apply for full exemption

Existing homes valued between $650,000 and $800,000: apply for a concessional stamp duty rate

Vacant land valued under $350,000: pay no stamp duty, apply for full exemption

Vacant land valued between $350,000 and $450,000: apply for a concessional stamp duty rate.

Here’s the general eligibility criteria for the scheme:

Buyers must be over 18

They also need to be Australian citizens or permanent residents

Only first home buyers are eligible

Within 12 months of buying the property, you must move in and live there for at least 6 months straight.

Want to get started on your home buying journey in NSW? Find out what your home loan options could be by booking a free appointment with your local Aussie Broker.