Just like with all the other Australian states and territories, the Northern Territory charges stamp duty on most property purchases.

So, if you plan on buying a home in the Northern Territory, this is something you should budget for as it’s likely to be one of the largest upfront property-buying expenses you’ll have.

In this article we’ll explain what stamp duty is, how it is calculated, how the rates of duty work in the NT, as well as the concessions and exemptions available to eligible homebuyers.

What is stamp duty?

Also known as transfer duty, stamp duty is a fee you pay to the government when purchasing land, property and some other assets. It’s a fee you pay to transfer ownership of the asset into your name.

Stamp duty is like a tax. The money it generates is put back into the economy by funding public sectors (e.g. education, roads and transport, healthcare, emergency services).

For properties, the rate of stamp duty varies between states and territories across Australia. It’s important to refer to information specific to the state where you will be purchasing property.

How is stamp duty calculated?

While the rates of stamp duty may differ across Australia, there are several common factors that influence it:

The value of the property or sale cost (whichever is higher)

The location of the property (which state/territory it is in)

The type of property (e.g. owner-occupied, investment property, whether the property is a unit or house)

Whether you are a first home buyer

Whether you are classed as a foreign buyer.

To get an idea of how much stamp duty you could be charged, check out Aussie’s Stamp Duty Calculator.

How does stamp duty work in the NT?

In the Northern Territory, stamp duty must be paid within 60 days of settlement on the Northern Territory Government Integrated Revenue Application website.

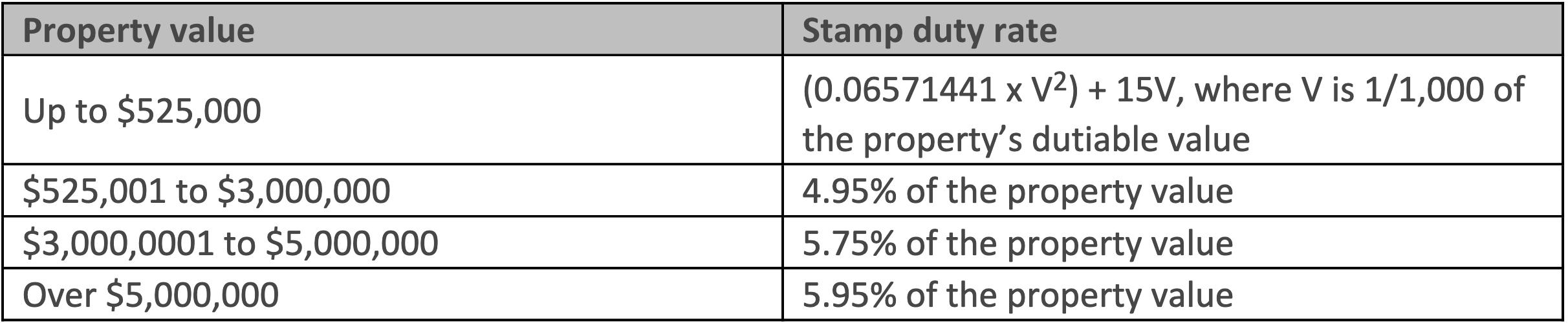

The rates of stamp duty are as follows:

Do foreign buyers in the NT have to pay additional duty?

Foreign buyers in the NT may have to pay an additional duty amounting to 8% of the property’s value.

How much is stamp duty on an off-the-plan purchase in the NT?

There can be money-saving benefits to purchasing off-the-plan in the Northern Territory when it comes to stamp duty.

Stamp duty for off-the-plan purchases in the NT is calculated on the value of the property on the date of the sale contract, rather than the value of the property once construction has been completed.

Given that the property will likely significantly increase in value once the dwelling is complete, this can mean major savings on transfer duty.

What stamp duty concessions and exemptions are available in the NT?

If you purchase a house and land package from a building contractor between 1 July 2022 and 30 June 2027 in the NT, you could be exempt from paying stamp duty.

This scheme is called the House and Land Package Exemption (HLPE) and there isn’t a cap on the property value, nor is it means-tested.

First Home Owner Grant

While the Northern Territory no longer has a lot of different stamp duty concessions, first home buyers should check to see whether they are eligible for the First Home Owner Grant.

Under the scheme, eligible first home buyers could apply for a $10,000 grant. To be eligible, you must:

Not have owned a residential property in Australia

At least one applicant must be 18 years of age or older

At least one applicant must be an Australian citizen or permanent resident

Applicants must lodge the application within 12 month of the property transaction

The property must be a new home or you must be building a new home

You cannot have previously received the First Home Owner Grant in any other state or territory.

While this scheme isn’t directly linked to stamp duty, buyers can put those funds towards paying their duty fees.

Do you have to pay stamp duty again when refinancing in the NT?

Did you know that there are some circumstances in which borrowers may have to pay stamp duty again for the same property?

If you opt to refinance your mortgage for a larger amount than the original loan, you could be liable to pay some stamp duty fees again. Typically, these fees are only applied on the difference between the original and new amounts.

Note that unless eligible for concessions, you will have to pay stamp duty when moving into a new home – even if you are able to port your existing loan to the new property.

Can you add stamp duty to your mortgage in the NT?

No, you cannot put your stamp duty on your home loan in the Northern Territory. If you are unable to front up the costs of stamp duty, it may be better to wait until you can afford the cost before you commit to a property.

However, if you have a large home loan deposit, you may be able to use money from the deposit to cover the cost of stamp duty. Remember that doing this will increase the amount of money you need to borrow for you loan, and will increase your Loan to Value Ratio (LVR).

If your LVR exceeds 80%, it probably means that your deposit is now under 20% of the value of the property. This could mean that you will be charged Lenders Mortgage Insurance (LMI) – an additional fee that generally can be put on the mortgage.

Are you ready to apply for a home loan?

Want to get started on your home buying journey? Find out what your home loan options could be by booking a free appointment with your local Aussie Broker.