When you’re saving up funds to purchase property in Western Australia, don’t forget to save for stamp duty.

The WA Government is making it easier for first-home buyers by increasing the stamp duty exemption and concession thresholds, helping more buyers pay less upfront when purchasing a home.

While building up a home loan deposit might be your focus, it’s not the only major upfront cost you’ll have to pay. Depending on the value of the property you buy, stamp duty could cost upwards of tens of thousands of dollars.

In this article, we’ll explain what stamp duty is, how it’s calculated, how it works in WA and the concessions and exemptions that are on offer.

UPDATE: Western Australia expands stamp duty exemptions to make home ownership easier

Western Australia has just announced an increase to its stamp duty exemptions for first-home buyers. The changes are designed to make it easier for more people to get into their first home, by reducing some of the upfront costs that come with buying.

Here's a quick look at what's changed:

Stamp Duty Category | Previous Thresholds | New Thresholds |

|---|---|---|

Full stamp duty exemption (established homes) | Up to $450,000 | Up to $500,000 |

Concessional rate applies (established homes) | $450,000 to $600,000 | $500,000 to $700,000 |

Source: wa.gov.au

As part of the update, the Western Australia Government has raised the thresholds for stamp duty exemptions and concessions on established homes. This means more first-home buyers can now access bigger savings when they buy a home.

What is stamp duty?

Also known as transfer duty, stamp duty is a fee you pay to the government when purchasing land, property and some other assets. It’s a fee you pay to transfer ownership of the asset into your name.

Stamp duty is like a tax. The money it generates is put back into the economy by funding public sectors (e.g. education, roads and transport, healthcare, emergency services).

For properties, the rate of stamp duty varies between states and territories across Australia. It’s important to refer to information specific to the state where you will be purchasing property.

How is stamp duty calculated?

While the rates of stamp duty may differ across Australia, there are several common factors that influence it:

The value of the property or sale cost (whichever is higher)

The location of the property (which state/territory it is in)

The type of property (e.g. owner-occupied, investment property, whether the property is a unit or house)

Whether you are a first home buyer

Whether you are classed as a foreign buyer.

To get an idea of how much stamp duty you could be charged, check out Aussie’s Stamp Duty Calculator.

How does stamp duty work in WA?

When purchasing property in Western Australia, you’ll have to pay residential stamp duty to the WA Department of Finance – unless you are eligible for an exemption.

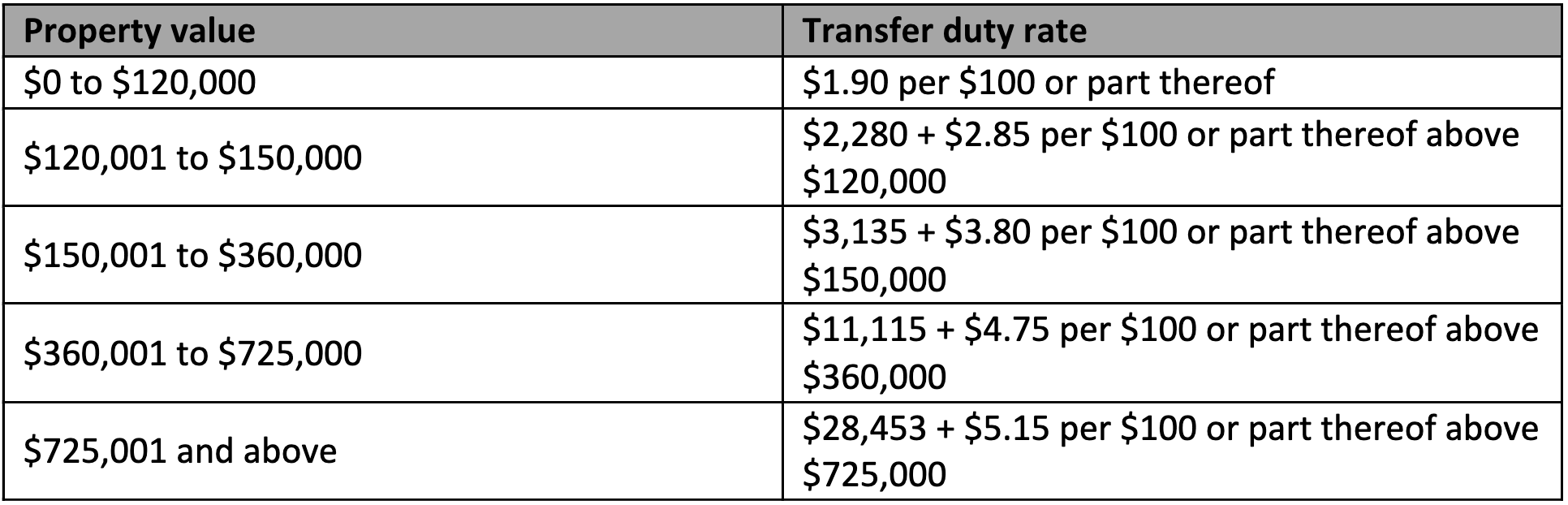

Here are the rates of duty for properties in WA:

How is stamp duty calculated in WA for commercial and rural properties?

For commercial and rural properties in WA, stamp duty is calculated at a general rate. Note that rural properties in this case are properties not used as residential property, as well as vacant land that doesn’t qualify for the residential rate of duty.

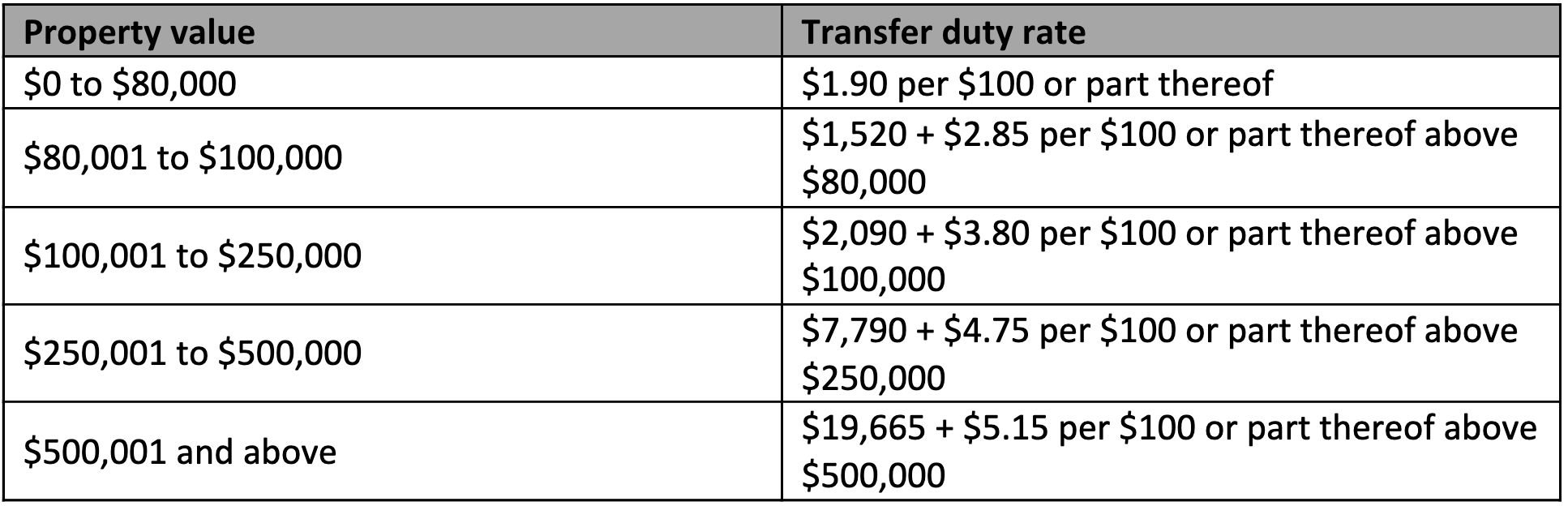

Here are the rates of duty for commercial and rural WA properties:

Do foreign buyers in WA have to pay additional duty?

Foreign buyers in WA may have to pay an additional duty amounting to 7% of the property’s value.

What stamp duty concessions and exemptions are available in WA?

First home buyer concessional rate of duty

First home buyers in WA may be eligible for a discounted stamp duty rate. If you’re purchasing a home and land that does not exceed a value of $450,000 (increased from $430,000), you won’t be required to pay stamp duty,

For properties purchased that are valued between $450,000 and $600,000 (increased from $530,000), transfer duty is charged at $19.19 per $100 above $450,000.

If you’re buying vacant land, you are exempt from paying stamp duty if it is valued at or below $300,000. For land valued between $300,000 and $400,000, transfer duty is charged at $13.01 per $100 above $300,000.

Foreign buyers may still be eligible for the first home owner rate of duty but a foreign transfer duty will likely apply. The eligibility criteria for the concession are as follows:

Buyers must not have previously owned property in Australia

Buyers can be Australian citizens and permanent residents

Properties valued between $450,000 and $600,000, duty will be payable at a rate of $15.01 for every $100, or part of $100, by which it exceeds $450,000 (decreased from $19.19)

Vacant land valued between $300,000 and $400,000 is charged duty at $13.01 per $100 above $300,000

Purchases of vacant land valued at or below $300,000 are exempt from paying stamp duty.

How much is the off-the-plan stamp duty rebate in WA?

Those who buy a residential unit or apartment off-the-plan may be eligible for a stamp duty rebate. The existing rebate scheme has been extended to 24 October 2023.

The rebate is available to both owner-occupiers and investors who enter into a pre-construction contract between 23 October 2019 and 24 October 2023 for the purchase of a new residential apartment or unit. Here are the stamp duty rebates buyers could get under the scheme:

For properties valued under $500,000, you can get 100% of the stamp duty paid rebated (to a maximum of $50,000)

For properties valued between $500,000 and $600,000, you can get between 100% and 50% of duty rebated. The rebate of 100% reduced at a 0.05% rate for every $100 in dutiable value exceeding $500,000 (to a maximum of $50,000)

For properties valued at $600,000 or more, you can get 50% of the duty rebated (to a maximum of $50,000).

Want to get started on your home buying journey in WA? Find out what your home loan options could be by booking a free appointment with your local Aussie Broker.